If You’re on the Fence, It’s Safe to Say It’s Time to Jump Off!

Mortgage rates are up 0.875% since mid-November, causing home buyer purchasing power across Iowa to fall more than 10 percent since.

Mortgage rates are up 0.875% since mid-November, causing home buyer purchasing power across Iowa to fall more than 10 percent since.

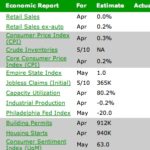

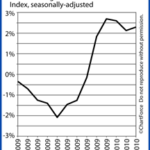

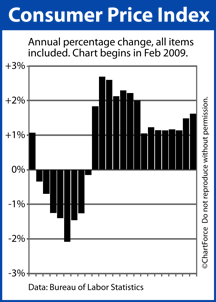

Persistent concerns over inflation are a major reason why and this week’s Consumer Price Index did little to quell fears. CPI rose for the third straight month last month.

Wall Street was not surprised. Honestly, neither was I. We’ve been talking about it for several months.

As the economy has picked up steam since late-2010, the Federal Reserve has held the Fed Funds Rate near zero percent, and kept its $600 billion bond plan moving forward. The Fed believes this is necessary to support the economy in the near-term.

Over the long-term, however, Wall Street worries that these programs may cause the economy may expand too far, too fast, and into runaway inflation. Which as you might remember from our previous posts, this is bad for mortgage rates (see below).

Inflation Pressures Mortgage Rates to Rise

Inflation is an economic concept; defined as when a currency loses its value. Something that used to cost $1.00 now costs $1.05, for example. It’s not that the goods themselves are more expensive, necessarily. It’s that the money used to buy the goods is worth less.

Because of inflation, it takes more money to buy the same amount of product.

This is a big deal in the mortgage markets because mortgage rates come from the price of mortgage bonds, and mortgage bonds are denominated, bought, and sold in U.S. dollars. When inflation in present, the dollar loses its value and, therefore, so do mortgage bonds.

When mortgage bonds lose value, mortgage rates go up.

Inflation fears are harming Iowa home buyers. The Cost of Living has reached a record level, surpassing the former peak set in July 2008. Mortgage rates would be rising more right now if not for the Middle East unrest.

So long as inflation concerns persist, mortgage rates should trend higher over the next few quarters. If you’re wondering whether to lock or float your mortgage rate, consider locking today’s sure thing. If you haven’t locked in yet, reach out to me. I love to work with my readers and locking in a mortgage rate is more of a “hands on” process. That means I do a much better job advising you one-on-one rather than through daily blog posts! All of my contact information is on the right hand side of this page.