Rates Saw Biggest 1 Day Spike Since November

The week’s news schedule was full. It included debt ceiling debates, jobs figures, and ongoing maneuverings within the Eurozone.

Each story a material impact on mortgage rates and, as a result, rates varied wildly from day-to-day.

Throughout the early part of the week, mortgage rates fell.

Monday, bond markets improved as leaks of the congressional debt ceiling agreement surfaced. Investors approved of the accord’s general terms and bought U.S.-backed debt to prove it. Tuesday, when the final agreement was reached and the terms were made public, mortgage rates dropped again.

This is because the debt ceiling agreement is based on spending cuts and tax increases. In response, analysts revised lower their respective growth estimates for the United States, benefiting bonds.

By Thursday, markets were in full rally mode.

On the eve of the July jobs report, traders flocked to the ultra-safe bond market; “whispers” put the net jobs created figure at a negative. Wall Street feared the worst. By Thursday’s close, mortgage pricing was at its best levels since November 2010.

Friday morning, though, markets recoiled. When the Non-Farm Payrolls report showed much-better-than-expected growth, it triggered a bond market sell-off and rates reversed higher. Rates rose more Friday than on any single day since November 30, 2010.

If you were quoted a mortgage rate on Thursday, on Friday, the same mortgage rate cost 1 discount point more.

Specifically, What Did Those Reports Say?

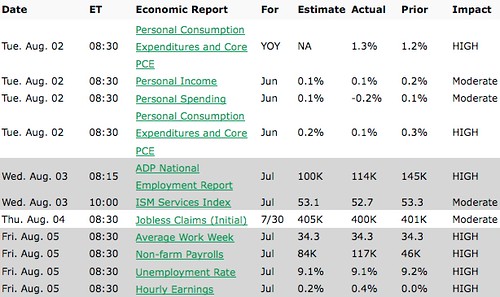

Each week, I put up an economic calendar of news coming out that following week. Here’s the what actually happened with those reports last week:

What Impacts Mortgage Rates?

If you’re looking to purchase or refinance a home, it’s important to know what moves mortgage rates. There are normally two major things that impact the direction:

- Economic News. (Like the calendar above).

- International News. (major events, pending legislation, war related news, etc).

- Stock Market. (Money flows from equities (stocks) to bonds when it seeks shelter).

What Are Rates Based On?

It’s been mentioned before, but as a common reminder – mortgage rates are only based on one thing, Mortgage Backed Securities (MBS). The only way you have access to these is through live bond quotes.

Looking For Mortgage Rates?

If you’re looking for specifically what mortgage rates are doing, I’d be happy to help with a custom rate quote. Each scenario is different (there are 27 different factors a mortgage rate is determined by). If you or someone you currently know are looking for a mortgage, I’m here to help!

Information without obligation. That’s my policy. If you like what you hear, my team and I would love to help you out with your mortgage! Our contact information is on the top right hand side of this page!