Breaking The News

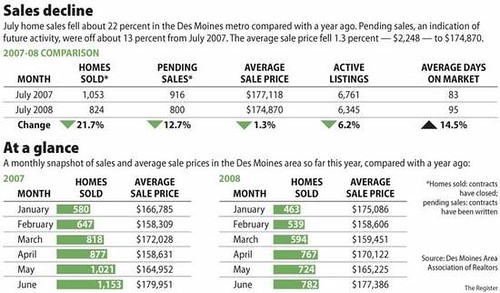

We all know the housing market is down. Not shocking, I know. You have to recognize the important part of living in Des Moines, we haven’t seen near the declines the rest of the country. There was a recent article in the Des Moines Register that clearly illustrated what has happened recently versus what was happening roughly a year ago.

Inside the Story

As I’d mentioned, Donnelle Eller wrote the recent story in the Register. The portion that I found most helpful were the statistics.

Here’s the graphic that was featured (courtesy of The Des Moines Register):

My Opinion

It’s obvious, based on the numbers – home sales are down.

In my personal opinion, the reason why is that the ‘sales process’ is now taking longer. What I mean by that is that sellers aren’t always realistic with their asking price. If a seller sits on the market, they cannot move forward and purchase the new home. This is why I think that homes are staying on the market longer and sales prices are declining (slightly).

My Concern

Ok, here we go – I see a bottleneck coming. I do not have statistics to support it (although I’m sure they would). Many of the homes that have sold in Des Moines have been first time homebuyers. Up until now (or 30 days from now), buyers didn’t have to have any money down. There were some opportunities to get low/no money down mortgage solutions.

Moving forward, home buyers will be required to bring in 3%-5% as a down payment. Yes, there are exceptions, but Des Moines has very few of them. With that said, the number of qualified home buyers is slowly shrinking. I personally think that these numbers will look much less sexy come the next few months.

Give it time, but the qualified buyer pool is shrinking.

My Advice

If you’re a seller: I’d recommend you get extremely realistic with your asking price. You may not get top dollar for your home. If you’ve got a professional working for you (a Realtor), you should be able to buy your next home right.

If you’re a buyer: I’d recommend you get pre-approved. Today, not next month. This means you get your income, assets, everything to your mortgage lender. You not only need to make sure you’re pre-approved today, but you also need someone that will tell you how the changing mortgage market impacts YOU directly. Trust me, you’ll thank me later.

If you’re a Realtor (or any other professional resource): Be honest. I don’t think it’s helping anyone to place nice cop. If you have a friend or client that is looking at buying, advise them to talk with a professional that understands what is happening. It’s not a perfect time for everyone to buy, but it is a great time for everyone to talk through this.

{ 2 comments… read them below or add one }

I wonder how many deals fall out of escrow because someone mis-managed the loan process. Unfortunately I’ve heard of too many of those instances. I can’t stress enough how important it is to get approved early and to be up-front with your lender (I’m sure you would agree).

@Ricardo – It’s always good to get you involved in the conversation 😉

I agree 100%. Pre-approvals are key. Also equally important, is working with a mortgage professional that continues to manage your pre-approval as you shop for a home. Guidelines change so quickly anymore, you could be approved one day and then denied the next!