The Fed Keeps It’s Course

Big news this week was that on Wednesday, the Fed decided to keep the Fed Funds Rate steady at the current 0 – .25% range, the lowest it’s ever been. They also indicated that “economic conditions are likely to warrant exceptionally low levels of the Federal Funds Rate for some time” and in my opinion most importantly that “inflation pressures will remain subdued in coming quarters”. Remember, inflation’s bad news for mortgage rates.

Are You a Bad Bank? You May Be In Luck!

The Federal Deposit Insurance Corp (FDIC) announced that it may set up a “bad bank” as a vehicle to buy toxic or illiquid assets from banks. So, what does a “bad bank” do? As I’ve talked about in the past, lenders and the entire financial sector are struggling with “mark-to-market” accounting issues, and in the absence of a repair of the mark-to-market system, lenders are forced to sell assets in a market where there are few buyers.

This is where the bad bank plan comes into play. It would create an entity that will purchase the assets that no one else will buy, which is yet another very creative way for the government to breathe life back into the financial sector. This action is not finalized, so we’ll keep watching closely to see how it plays out in the days ahead. It would be a good move.

Some Stimulus

In other news, the House of Representatives passed President Obama’s $819B stimulus package, by a vote of 244-188, being split fairly cleanly by party lines. Existing Home Sales did surprisingly come in a bit better than expected, but 4th Quarter Gross Domestic Product (GDP) numbers showed the economy contracted in the 4th quarter. While the numbers were better than estimates, the economy was still at its slowest pace in 26 years.

Last week was indeed action packed, and Bonds and home loan rates felt the effect, with rates ending about .25% higher than where they began.

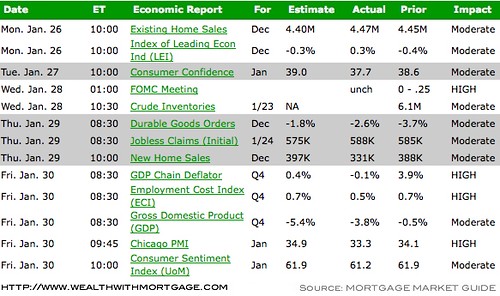

Specifically, What Did Those Reports Say?

Each week, I put up an economic calendar of news coming out that following week. Here’s the what actually happened with those reports last week:

What Impacts Mortgage Rates?

If you’re looking to purchase or refinance a home, it’s important to know what moves mortgage rates. There are normally two major things that impact the direction:

- Economic News. (Like the calendar above).

- International News. (major events, pending legislation, war related news, etc).

- Stock Market. (Money flows from equities (stocks) to bonds when it seeks shelter).

What Are Rates Based On?

It’s been mentioned before, but as a common reminder – mortgage rates are only based on one thing. Mortgage Backed Securities (MBS). The only way you have access to these is through live bond quotes.

Looking For Mortgage Rates?

If you’re looking for specifically what mortgage rates are doing, I’d be happy to help with a custom rate quote. Each scenario is different (there are 27 different factors a mortgage rate is determined by). If you or someone you currently know are looking for a mortgage, I’m here to help!

Information without obligation. That’s my policy. If you like what you hear, my team would love to help!