More To It Than Mortgage Rates

I’ve said it before, shopping for low mortgage rates can be a game of luck. Some days, mortgage rates are favorable. Other days, they’re not. And while you can make an educated guess about where rates might be headed, you’ve got a 50% shot at being right. Even the experts get it wrong more often than they’d like.

Here’s the game-changer though: There’s much more to getting a home loan than just mortgage rates.

Some parts of the rate shopping process can be predicted and one of them is surprisingly the future of mortgage guidelines.

Reevaluating Risk

In general, the more often homeowners default on their mortgages, the harder it is for future mortgage applicants to be approved.

This is why now may be the best time to apply for a mortgage, more specifically an FHA mortgage.

The Nasty Truth

Here’s the fact: Defaults are climbing, suggesting that FHA underwriting guidelines are about to tighten.

You may not know, but the FHA has implemented two major changes since last summer:

- The minimum downpayment requirement was raised by a half-percent to 3.5%

- Cash out refinances are now limited to 85 percent, down from 95 percent.

These changes create huge barriers to entry for potential FHA borrowers. Remember, this was intended to improve the overall quality of the FHA loan pool. Since FHA is a taxpayer-funded agency, loan performance is a big goal. Therefore, as the number of defaults grow, expect FHA guideline to get tighter, potentially much tighter.

What Changes Will Take Place? How Soon?

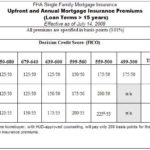

The problem with this though, is that we can’t predict just where the FHA will tighten. Maybe FHA decides to raise its minimum FICO score requirement, or maybe it gets tougher on seller-paid closing costs. Don’t leave out the opportunity to raise loan fees – it’s that’s the path Fannie Mae took just a year ago.

Whatever the FHA ends up doing, fewer people will qualify for FHA mortgages once it’s done. So, if you’re planning to buy a home and your downpayment is limited, or your credit scores are less than perfect, or there’s some other “red flag” in your loan application, consider moving up your timeframe to act.

Mortgage rates may rise or mortgage rates may fall, but neither is going to matter if you can’t get qualified for a home loan. Like I said, for FHA mortgage applicants, tougher mortgage guidelines are simply only a matter of time.

(Image kudos: The Wall Street Journal Online)