The Truth

Getting approved for a home loan isn’t getting easier, but it doesn’t appear to be getting much more difficult, either. Which is good news really.

Gathering Information

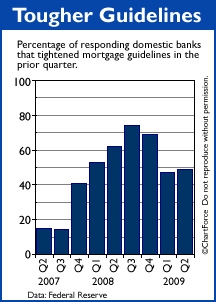

In a quarterly survey to member banks, the Federal Reserve asked senior bank loan officers if “prime” residential mortgage guidelines have tightened in the last 3 months.

Almost 50 percent of banks said that their guidelines tightened last quarter. This is a much lower figure than all of 2008 and a signal that mortgage lending may be turning a corner.

Comparing Notes

Guidelines remain tighter than they used to though.

Compared to 18 months ago, borrowers are now seeing the following:

- Higher minimum credit score thresholds (FHA loans often require 620 FICO scores now).

- Larger minimum downpayments (FHA now requires a 3.5% down payment).

- Lower debt-to-income requirements

- Mandatory fees based on certain loan traits

In addition to a lot of changes on first mortgage guidelines, the availability of subordinate financing has almost disappeared when a home’s loan-to-value goes over 80 percent. Fortunately, I’ve teamed up with some local banks to facilitate some of these options, but it’s still very scarce when compared to 12 months ago.

The Effect

All of these changes combined, it keeps a lot of Americans from getting access to today’s low rates. However, that could change in the coming months if the trend in the graph above continues.

Some experts believe that credit tightening started the recession. You’d think that some credit loosening could lead us out.