The Volatility Continues

Mortgage markets finished out the week unchanged last week but that’s not to say that mortgage rates stayed flat throughout the week.

From day-to-day, mortgage rate shoppers were on a roller coaster.

- Monday and Tuesday, rates dipped

- Wednesday and Thursday, rates surged higher

- Friday, rates retreated back

Overall, conforming mortgage rates carved out a half-percent range this week. This caused fit for home buyers in need of a rate lock, and homeowners interested in refinancing. If you missed your chance, it may not be too late. But you’ll benefit from having a mortgage professional watching things closely for you.

Specifically, What Did Those Reports Say?

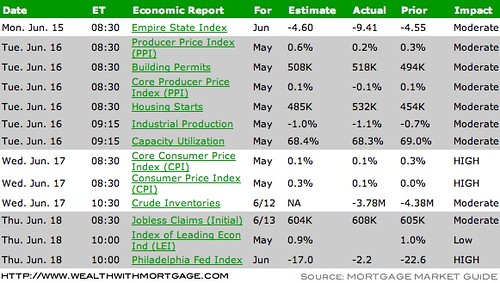

Each week, I put up an economic calendar of news coming out that following week. Here’s the what actually happened with those reports last week:

What Impacts Mortgage Rates?

If you’re looking to purchase or refinance a home, it’s important to know what moves mortgage rates. There are normally two major things that impact the direction:

- Economic News. (Like the calendar above).

- International News. (major events, pending legislation, war related news, etc).

- Stock Market. (Money flows from equities (stocks) to bonds when it seeks shelter).

What Are Rates Based On?

It’s been mentioned before, but as a common reminder – mortgage rates are only based on one thing, Mortgage Backed Securities (MBS). The only way you have access to these is through live bond quotes.

Looking For Mortgage Rates?

If you’re looking for specifically what mortgage rates are doing, I’d be happy to help with a custom rate quote. Each scenario is different (there are 27 different factors a mortgage rate is determined by). If you or someone you currently know are looking for a mortgage, I’m here to help!

Information without obligation. That’s my policy. If you like what you hear, my team and I would love to help you out with your mortgage!