Large Leaps in Jobs Could Cause Rates to Follow Suit

On the first Friday of every month, the government releases it’s Non-Farm Payrolls data from the month before. The data is more commonly called the “the jobs report” and it swings a big stick on Wall Street. Yea, a stick.

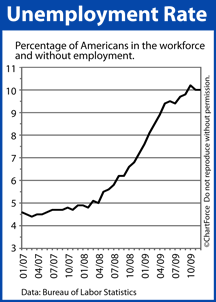

With little else to depend on, many analysts believe job growth is tightly linked to the future of the U.S. economy.

This is why I think when January’s jobs report hits the wires at 8:45 AM ET tomorrow, Ankeny home buyers would do well to pay close attention.

Wall Street expects that the economy added 13,000 jobs last month. It would mark the second time in 3 months that the jobs report showed a net monthly gain.

In November 2008, the economy added a strong 4,000 jobs.

Job Growth Jump Starts the Economy

Jobs matter to the economy for a lot of reasons. One of the biggest is that when Americans are working, Americans are buying and consumer spending accounts for a very big, seventy percent of the economy.

Job growth spurs the economy and draws money to the stock market. Unfortunately for rate shoppers, that kind of stock market growth happens at the expense of the bond market which is where mortgage rates are made.

In other words, good news for the economy is bad news for mortgage rates.

Also interesting, job growth can lead to higher home prices. This is because working homeowners are less likely to default on a mortgage versus non-working homeowners. In this way, job growth helps hold foreclosures to a minimum which, in turn, keeps housing supply in check.

Less supply means higher prices for home buyers. Oh yes, the old supply and demand lesson.

If you’re shopping for a mortgage rate, the prudent play may be to lock your rate before the jobs data is released. A jobs figure that’s higher than the 13,000 expected could cause rate to rise sharply. After today’s rally for improvement in rates, it would be smart to lock your gains in.

If you’re currently looking for a mortgage and don’t have proper representation, please feel free to contact us. We’d love to help!