Rates & Guidelines Are Constantly Changing

The mortgage lending world changes a lot and it creates challenges for buyers in Des Moines that aren’t paying in cash.

The loan you get today won’t always be the loan you get tomorrow. It’s sort of like watching the stock market.

Because of how frequently bank rules are changing, it can be hard for average Joes to distinguish between mortgage fact and fiction of “what’s coming next”.

Recently, we saw this with respect to FHA home loans.

January 20, 2010, the FHA issued a press release with new lending guidelines. Specifically, it announced 3 changes that will be effective starting April 5, 2010:

- Upfront mortgage insurance premiums increase from 1.75% to 2.25%

- Allowable seller concession reduced from 6% to 3%

- FICO scores of 580 or lower are subject to a minimum 10% downpayment

Borrowing will Become More Expensive Starting April 5, 2010

Also in the official statement, FHA announced it would ask Congress for permission to raise monthly mortgage insurance premiums. This is where the rumormill started.

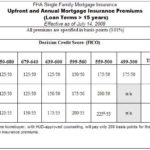

Nestled on page 348 of the Budget of the United States Government, Fiscal Year 2011, in a section titled Special Topics, there is a 1-paragraph notation that details the FHA’s petition.

- Raise monthly premiums by roughly 0.30%, or $25 per $100,000 borrowed per month

- Lower upfront mortgage insurance premiums by 1.25%, or $1,250 per $100,000 borrowed at closing

For now, the request is neither approved and it’s also not acknowledged by Congress. It’s merely a request. Nice, huh? And in the event that Congress does approve it, that doesn’t mean that FHA has to stand by its initial projections.

Truth is, about the only thing we know about the future of FHA lending is that, come April 5, 2010, borrowing money is going to be tougher, and more expensive. These are the facts as we know them today.

Homebuyers should plan accordingly. If you need to get your FHA loan registered prior to April 5th (you should if you haven’t), please contact me. I’d be happy to help you out!