Just What Exactly Happened Last Week?

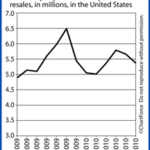

Mortgage markets had a terrible, holiday-shortened week last week. Wall Street was responding to worse-than-expected inflation data and action from the Federal Reserve. Mortgage bonds sold off quickly, causing mortgage rates to rise for the second week in a row. Luckily, it wasn’t a surprise if you had a loan officer paying attention to the market.

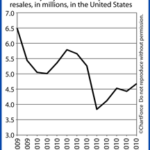

Last week was a bad week to float a mortgage, to say it nicely. Rates in Des Moines rose by the largest margin in any week since late-2009. Yea, seriously.

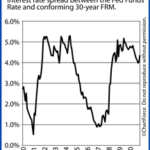

The two biggest stories from last week both came from the Federal Reserve. The first was the release of the FOMC January meeting minutes which showed more confidence in the U.S. economy than Wall Street expected. Second was the Fed’s surprise announcement to raise the nation’s Discount Rate to 0.75%. Both sparked risk-taking on Wall Street and bonds sold-off as a result.

Now, the Fed Funds Rate won’t climb anytime soon and neither will Prime Rate, but the Fed has sent a clear message to the markets — The Era of Loose Monetary Policy is over. They *will* tighten. It’s just a matter of when.

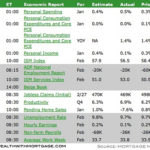

Specifically, What Did Those Reports Say?

Each week, I put up an economic calendar of news coming out that following week. Here’s the what actually happened with those reports last week:

What Impacts Mortgage Rates?

If you’re looking to purchase or refinance a home, it’s important to know what moves mortgage rates. There are normally two major things that impact the direction:

- Economic News. (Like the calendar above).

- International News. (major events, pending legislation, war related news, etc).

- Stock Market. (Money flows from equities (stocks) to bonds when it seeks shelter).

What Are Rates Based On?

It’s been mentioned before, but as a common reminder – mortgage rates are only based on one thing, Mortgage Backed Securities (MBS). The only way you have access to these is through live bond quotes.

Looking For Mortgage Rates?

If you’re looking for specifically what mortgage rates are doing, I’d be happy to help with a custom rate quote. Each scenario is different (there are 27 different factors a mortgage rate is determined by). If you or someone you currently know are looking for a mortgage, I’m here to help!

Information without obligation. That’s my policy. If you like what you hear, my team and I would love to help you out with your mortgage! Our contact information is on the top right hand side of this page!