Newspapers Just Don’t Cut it Anymore

Friday morning, headlines in Iowa and around the country read that mortgage rates were down 0.04%, on average, since the week before.

Asa reminder, here’s a couple of the headlines:

- US Mortgage Rates Drop For 2nd Straight Week (on Reuters)

- Mortgage Rates On 30-year US Loans Fall To 4.93% (on Business Week)

- 30-Year Fixed Mortgage Rate Falls Farther Below 5% (on Marketwatch)

The story behind the headline came from the Freddie Mac Primary Mortgage Market Survey (PMMS), am industry-wide mortgage rate poll of more than 100 lenders. The PMMS has reported mortgage rate data to markets since 1971 and is the largest of its kind.

Unfortunately, if you’re looking for mortgage rates — you can’t rely on it.

When consumers are in need mortgage rate information, they need the information delivered in real-time; for making decisions on-the-spot. Consumers need to know what rates are doing right now.

Rates Change Constantly–All Day, Every Day

Unfortunately, The Freddie Mac survey can’t offer that.

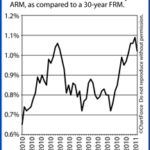

According to Freddie Mac, the survey’s method is to collect mortgage rates from lenders between Monday and Wednesday and to publish that data Thursday morning. The survey results are an average of all reported mortgage rates. The problem is that mortgage rates change all day, every day. The PMMS results are skewed, therefore, by methodology.

And, meanwhile, the issue was compounded last week because mortgage rates shot higher Wednesday afternoon — after the survey had closed out. The market deterioration ran into Thursday, too — again, unable to be captured by Freddie Mac’s PMMS.

Although the newspapers reported mortgage rates down last week, they weren’t. Conforming mortgage rates were higher by at least 1/8 percent, or roughly $11 per $100,000 borrowed per month. In some cases, rates were up by even more. If the people writing the article were getting a mortgage, they could have told you that. Unfortunately, we can’t keep them constantly in the process of buying or refinancing homes (that’s a joke…haha).

Back to the topic – Newspapers and websites can give a lot of good information, but pricing is far too fluid to rely on a reporter. When you need to know what mortgage rates are doing in real-time, make sure you’re talking to a loan officer. Otherwise, you may just be getting yesterday’s news.

If you’re currently in the process of getting a loan and need some help in locking in the best rate possible, please contact me. I would be happy to help you out. Even better, our rates are really good.