Which Way Will Mortgage Markets Move?

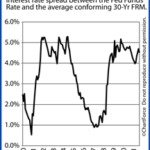

Emergency! The Federal Reserve has called an emergency meeting to review its Discount Rate policy. The meeting was called for today, Monday April 5, at 11:30 AM ET. It’s unknown exactly what the meeting will cover, but if new monetary policy is made, expect that mortgage rates will be influenced by this talk.

Also worth watching this week are the technical trading patterns present in the mortgage-backed bond market. Patterns tell us a lot. I’ll be watching mortgage movement very closely to cue in on which trend they’ll follow.

Helping you get inside my head: Unlike fundamental trading in which markets move simply on data and projections, technical trading is how markets move based on patterns, over time. The two methods co-exist on Wall Street but, occasionally, technical forces can be stronger, leading markets to spike up or down. This week may be one of those times.

Putting Things Into Prospective

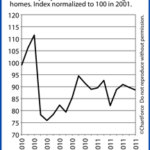

Mortgage pricing is far below its 200-day moving average, resting slightly above of a key support level. If pricing worsens this week and bonds fall below the support level, mortgage rates could easily tack on quarter-percents or more per day until the market refinds its balance. Sure, it’s doom or gloom, but it’s amazing what can happen in a day’s time!

Overall, it’s a week you don’t want your rate to be floating. Sure, rates could improve, but there’s a lot more room for them to worsen. If your purchase is still out a while, you should just see what things do.

If you’re currently in the market for a mortgage and need some advice, give me a call! I’d be happy to help you.

You Can Stay Updated!

I’ll be following things as they happen with live mortgage bond quotes and do what I can to keep everyone informed with live updates through Twitter.

As a Consumer, How Do You Keep Posted on the News?

I’ll do my best to keep you posted throughout the week via Twitter. If you’re interested in finding out more about what effects mortgage rates and which direction they’re headed, feel free to follow me!

Work With Mortgage Professionals In The Advice Business

It’s important to recognize that advice is extremely valuable when looking for a mortgage. The right advice can literally save you thousands of dollars, while the wrong advice can cost you the same. Some mortgage professionals really don’t know what mortgage rates are based on, period. If you want to get the best deal, having a professional that can give you that type of advice is extremely important.

Why Am I Posting A Calendar?

I provide this weekly news update because too often when we’re shopping around, we ask the wrong questions. The first thing you’ve got to have your antenna up on is economic news if you want to have any idea what direction rates are moving.

So You Say, What Are Mortgage Rates Currently?

I get this question all too often. If I’m being fair.. and honest (which is my policy). I would be doing you a huge disservice to just quote a rate.

Truth be told, there are literally 27 different factors that go into a custom rate quote. There are also thousands of programs (constantly changing as well). It’s extremely important that you are educated on what is available and most importantly what is the best mortgage plan for you to personally implement.

It’s natural to have a list of questions. I’d love to help work through them with you and educate you on what you need to know about the mortgage process. I can help with everything from how to pre-qualified to what to do after closing (where I will continue working for you)!

It’s what we do, and it would be my honor to add you to our list of raving fan clients. If you’re currently looking for a mortgage loan or know someone that might have questions about one, please have them contact me. I’d be happy to assist them. It’s literally what I love doing! I promise to take great care.