Lock in Before Attention Turns Back to Job Growth

Mortgage markets improved to their best levels of 2010 last week, aided by events half a world away and ongoing safe haven buying. Greece’s debt problems continue to help mortgage rate shoppers in Urbandale and around the country.

Conventional mortgage rates dropped last week, ARMs falling more than fixed. FHA mortgage rates also improved.

Global concern for the Greece Situation are so strong that markets even shrugged off April’s blowout job report. On most other days, mortgage rates would soar on better-than-expected jobs data — especially coming out of a recession.

The Department of Labor’s April Non-Farm Payrolls reports:

- Payrolls have been net positive for 4 straight months

- Nearly 600,000 jobs have been created thus far in 2010

- Monthly job growth posted its biggest gain in 4 years in April

Additionally, more than 800,000 Americans re-entered the workforce in April in search of work. As a result, the Unemployment Rate jumped by 0.2 percent — another positive sign (in a roundabout way).

But again, Wall Street wasn’t watching jobs — Wall Street was watching Greece. And Greece was in riot. Yikes.

Specifically, What Did Those Reports Say?

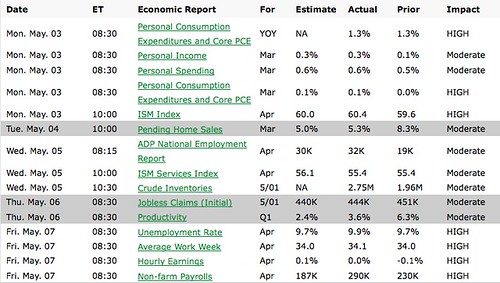

Each week, I put up an economic calendar of news coming out that following week. Here’s the what actually happened with those reports last week:

What Impacts Mortgage Rates?

If you’re looking to purchase or refinance a home, it’s important to know what moves mortgage rates. There are normally two major things that impact the direction:

- Economic News. (Like the calendar above).

- International News. (major events, pending legislation, war related news, etc).

- Stock Market. (Money flows from equities (stocks) to bonds when it seeks shelter).

What Are Rates Based On?

It’s been mentioned before, but as a common reminder – mortgage rates are only based on one thing, Mortgage Backed Securities (MBS). The only way you have access to these is through live bond quotes.

Looking For Mortgage Rates?

If you’re looking for specifically what mortgage rates are doing, I’d be happy to help with a custom rate quote. Each scenario is different (there are 27 different factors a mortgage rate is determined by). If you or someone you currently know are looking for a mortgage, I’m here to help!

Information without obligation. That’s my policy. If you like what you hear, my team and I would love to help you out with your mortgage! Our contact information is on the top right hand side of this page!