Confidence Leads to Spending

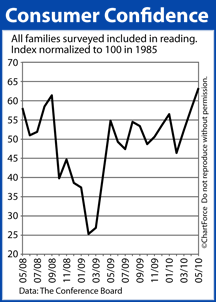

The Consumer Confidence Index is rising, a potentially double-edged sword for residents of Ankeny and for Americans, in general.

The Consumer Confidence Index is rising, a potentially double-edged sword for residents of Ankeny and for Americans, in general.

According to The Conference Board, economic confidence is as high as it’s been since August of 2007 — 4 months before the start of the recession. Americans are optimistic again.

Confidence matters to the economy because as confidence increases, in theory, consumer spending follows. Consumer spending accounts for 70 percent of the U.S. economy.

It’s why Wall Street is responsive to confidence data.

When consumer confidence is rising, households start to make big-ticket purchases they may have otherwise put off indefinitely. It could be anything from replacing old appliances to trading in an old automobiles or even splurging on a vacation.

Home Values Rise with Rising Consumer Confidence

Rising confidence can also spur real estate sales.

When confidence is rising, a growing family that chose to “make do” in their 3-bedroom, 1.5-bathroom starter home may opt to move-up to a four bedroom, three bathroom instead at a slightly higher monthly carrying cost. And there are families in every city in every state making those same decisions.

As a result, the housing market gets a boost — especially in the mid-to-upper price ranges. Values rise on higher demand for homes.

The downside is that growing confidence tends to push conforming and FHA mortgage rates up. This is because an expanding economy draws investment dollars away from bonds and into stocks — including mortgage bonds.

The reduced demand for mortgage-backed bonds leads bond prices to fall and mortgage rates to rise. Sometimes by a little, sometimes by lot.

So, if you’re buying a home or thinking of a refinance, rising confidence in the economy may be a signal to act sooner rather than later. Talk to your real estate agent and/or your loan officer about next steps and get your plan in place. If you don’t have someone to lean on for advice, I’d be happy to help. Just send me an email. I return all emails personally, and I’d love to help you out!