Rates Don’t Stay Low For Long, They Dip Quick and Shoot Back Up Even Faster

Rate shoppers caught another break last week as mortgage markets improved on weaker jobs data.

Rate shoppers caught another break last week as mortgage markets improved on weaker jobs data.

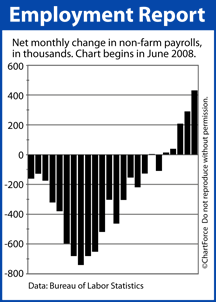

The May Non-Farm Payrolls report fell short of expectations while ongoing jobless claims rose. The two combined to cast doubt on the speed of the U.S. economic recovery, hurting stocks and helping bonds.

Conforming and FHA mortgage rates dropped in Iowa for the fifth time in six weeks and, once again, rates are trolling back near all-time lows.

No doubt you’ve heard that before — “mortgage rates at all-time lows”. Mortgage rates have dipped to these levels four times in the last 19 months. However, on each occasion, it wasn’t long after touching bottom before rates reversed higher.

- November 2008 : Roughly 90 minutes

- March 2009 : Roughly 6 hours

- May 2009 : Roughly 1 day

- May 2010 : Roughly 3 hours

Specifically, What Did Those Reports Say?

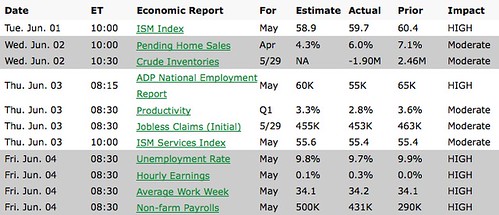

Each week, I put up an economic calendar of news coming out that following week. Here’s the what actually happened with those reports last week:

What Impacts Mortgage Rates?

If you’re looking to purchase or refinance a home, it’s important to know what moves mortgage rates. There are normally two major things that impact the direction:

- Economic News. (Like the calendar above).

- International News. (major events, pending legislation, war related news, etc).

- Stock Market. (Money flows from equities (stocks) to bonds when it seeks shelter).

What Are Rates Based On?

It’s been mentioned before, but as a common reminder – mortgage rates are only based on one thing, Mortgage Backed Securities (MBS). The only way you have access to these is through live bond quotes.

Looking For Mortgage Rates?

If you’re looking for specifically what mortgage rates are doing, I’d be happy to help with a custom rate quote. Each scenario is different (there are 27 different factors a mortgage rate is determined by). If you or someone you currently know are looking for a mortgage, I’m here to help!

Information without obligation. That’s my policy. If you like what you hear, my team and I would love to help you out with your mortgage! Our contact information is on the top right hand side of this page!