The Markets Listen When Bernanke Talks

Mortgage markets improved last week despite a huge mortgage bond sell-off Friday afternoon. Prior to the jump, conforming mortgage rates had cut new, all-time lows by Thursday, only to lose up to 0.250 percent on the last day of the week. It was truly painful to watch.

Mortgage markets improved last week despite a huge mortgage bond sell-off Friday afternoon. Prior to the jump, conforming mortgage rates had cut new, all-time lows by Thursday, only to lose up to 0.250 percent on the last day of the week. It was truly painful to watch.

Meanwhile, the same type of news that drove rates lower last Monday through Thursday also contributed to rates rising Friday — revised projections for the U.S. economy.

Early in the week, “bad” news piled on which, in turn, lowered expectations for the economy and pushed mortgage rates down:

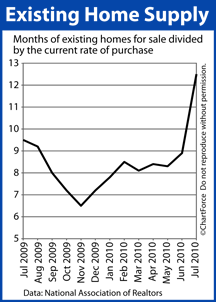

- Existing Home Sales dropped 27% from June

- Single-Family New Home Sales dropped 12% from June

- Purchases of “big ticket” items plunged

Then, on Friday, two events revised the market’s expectations back higher:

- Q2 GDP was revised lower, but not as low as had been expected

- Fed Chairman Ben Bernanke said the economy will keep expanding through the end of the year and into 2011

Bottom line: When Chairman Bernanke talks, markets listen. His comments about the U.S. economy helped fuel that late-Friday surge in mortgage rates last week. Stay on your toes folks, mortgage markets move quick.

If you’re currently looking at purchasing or refinancing and would like some assistance locking in a low rate, please contact me. I’d love to help you out. All of my contact information is off to the right hand side of this post.

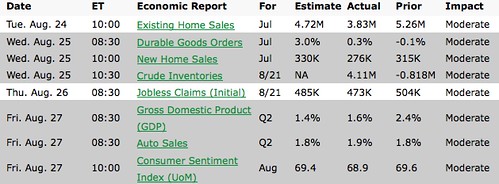

Specifically, What Did Those Reports Say?

Each week, I put up an economic calendar of news coming out that following week. Here’s the what actually happened with those reports last week:

What Impacts Mortgage Rates?

If you’re looking to purchase or refinance a home, it’s important to know what moves mortgage rates. There are normally two major things that impact the direction:

- Economic News. (Like the calendar above).

- International News. (major events, pending legislation, war related news, etc).

- Stock Market. (Money flows from equities (stocks) to bonds when it seeks shelter).

What Are Rates Based On?

It’s been mentioned before, but as a common reminder – mortgage rates are only based on one thing, Mortgage Backed Securities (MBS). The only way you have access to these is through live bond quotes.

Looking For Mortgage Rates?

If you’re looking for specifically what mortgage rates are doing, I’d be happy to help with a custom rate quote. Each scenario is different (there are 27 different factors a mortgage rate is determined by). If you or someone you currently know are looking for a mortgage, I’m here to help!

Information without obligation. That’s my policy. If you like what you hear, my team and I would love to help you out with your mortgage! Our contact information is on the top right hand side of this page!