When Rates Rise, They Rise Fast

Mortgage markets worsened last week as the U.S. dollar gave up ground in currency markets, and inflation concerns mounted. In response to the events, mortgage rates in Iowa rose for the third straight week. Ouch.

Mortgage markets worsened last week as the U.S. dollar gave up ground in currency markets, and inflation concerns mounted. In response to the events, mortgage rates in Iowa rose for the third straight week. Ouch.

Mortgage rates have now climbed by as much as half-percent since the start of the month, and Freddie Mac reported average loan fees to be higher, too. That means overall, the cost to borrow money has increased.

The 7-month rally in rates might just be nearing its end. The 30-year fixed rate mortgage is at a 4-month high after reaching an all-time low just 3 weeks ago. Some folks have been in denial, but the numbers don’t lie folks.

The abrupt change in rates makes for an interesting study in expectations, and how they can influence a market. Naturally, I’m the type of dorky person that studies those kinds of changes.

Inflation is Bad News for Mortgage Rates

Important Lesson Alert!

Inflation decreases the value of a dollar. In turn, as a consequence, it devalues repayments made to mortgage bond holders. At the end of the day, when inflation is present, mortgage bonds tend to sell-off which causes mortgage rates to rise.

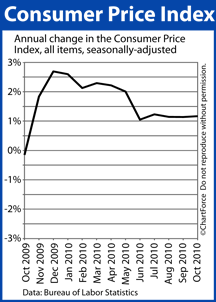

This is what’s been happening these past 3 weeks. However, we’re not in an inflationary environment. To the contrary:

- The Federal Reserve has said inflation is simply too low to be economically healthy

- Last week, the Cost of Living posted its lowest year over year gain in history

But mortgage rates are rising anyway. This is because global investors believe the Fed’s most recent market intervention — a $600 billion bond purchase program — will later lead to inflation. Just on the expectation, markets are behaving like inflation is already here.

Just remember, it’s not always about today’s news. It’s about what today’s news will mean to our future monetary policy.

It’s exhausting, isn’t it?

Specifically, What Did Those Reports Say?

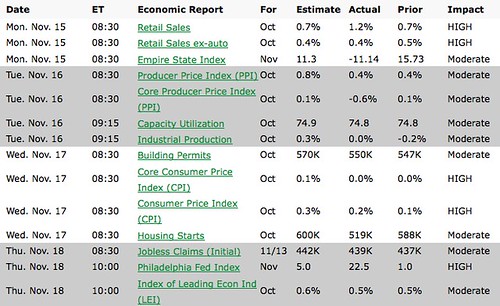

Each week, I put up an economic calendar of news coming out that following week. Here’s the what actually happened with those reports last week:

What Impacts Mortgage Rates?

If you’re looking to purchase or refinance a home, it’s important to know what moves mortgage rates. There are normally two major things that impact the direction:

- Economic News. (Like the calendar above).

- International News. (major events, pending legislation, war related news, etc).

- Stock Market. (Money flows from equities (stocks) to bonds when it seeks shelter).

What Are Rates Based On?

It’s been mentioned before, but as a common reminder – mortgage rates are only based on one thing, Mortgage Backed Securities (MBS). The only way you have access to these is through live bond quotes.

Looking For Mortgage Rates?

If you’re looking for specifically what mortgage rates are doing, I’d be happy to help with a custom rate quote. Each scenario is different (there are 27 different factors a mortgage rate is determined by). If you or someone you currently know are looking for a mortgage, I’m here to help!

Information without obligation. That’s my policy. If you like what you hear, my team and I would love to help you out with your mortgage! Our contact information is on the top right hand side of this page!