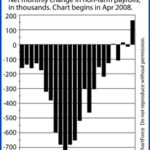

It’s Unclear Which Way Rates Will Go

There’s ongoing unease related to protests in Libya and its neighbors, and that’s driving safe haven buying (see below, as I’m freely using jargon in this blog post.).

There’s ongoing unease related to protests in Libya and its neighbors, and that’s driving safe haven buying (see below, as I’m freely using jargon in this blog post.).

“Safe haven buying” describes when investors flee risky situations and put their money in the safest places possible. Mortgage bonds are one such place, so when safe haven buying is in effect, bond demand is high so bond yields (i.e. mortgage rates) fall.

On the other side, inflation is ramping up.

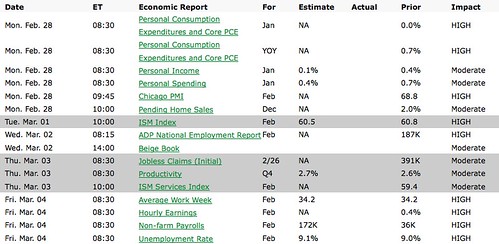

Recent economic data shows that the economy is expanding, and the Federal Reserve is maintaining its accommodating growth policies. Therefore, this week, the key economic event will be Friday’s jobs report. If job creation is high, expect inflation fear to re-ignite, and mortgage rates to rise.

Another risk factor for this week’s rate shoppers is that tensions begin to settle in the Middle East, or that Wall Street gets more comfortable with rising oil prices. If that happens, safe haven buying will subside and mortgage rates will resume rising.

There appears to be more reasons for mortgage rates to rise this week than for them to fall. Plan accordingly.

If you have not locked a mortgage rate yet, this week may represent your last chance to get a low one. If you’re trying to make that happen, please contact me. I’d love to help you out. All of my contact information is on the right hand side of this post.

Why Am I Posting A Calendar?

I provide this weekly news update because too often when we’re shopping around, we ask the wrong questions. The first thing you’ve got to have your antenna up on is economic news if you want to have any idea what direction rates are moving.

As a Consumer, How Do You Keep Posted on the News?

I’ll do my best to keep you posted throughout the week via Twitter. If you’re interested in finding out more about what effects mortgage rates and which direction they’re headed, feel free to follow me!

Work With Mortgage Professionals In The Advice Business

It’s important to recognize that advice is extremely valuable when looking for a mortgage. The right advice can literally save you thousands of dollars, while the wrong advice can cost you the same. Some mortgage professionals really don’t know what mortgage rates are based on, period. If you want to get the best deal, having a professional that can give you that type of advice is extremely important.

So You Say, What Are Mortgage Rates Currently?

I get this question all too often. If I’m being fair.. and honest (which is my policy). I would be doing you a huge disservice to just quote a rate.

Truth be told, there are literally 27 different factors that go into a custom rate quote. There are also thousands of programs (constantly changing as well). It’s extremely important that you are educated on what is available and most importantly what is the best mortgage plan for you to personally implement.

It’s natural to have a list of questions. I’d love to help work through them with you and educate you on what you need to know about the mortgage process. I can help with everything from how to pre-qualified to what to do after closing (where I will continue working for you)!

It’s what we do, and it would be my honor to add you to our list of raving fan clients. If you’re currently looking for a mortgage loan or know someone that might have questions about one, please have them contact me. I’d be happy to assist them. It’s literally what I love doing! I promise to take great care.