Rates Improved as a Result

Mortgage markets improved last week, carried by the same stories that have led markets better since April. Worries of a Eurozone sovereign debt default mounted, and the U.S. economy’s revival showed itself to be slower than originally anticipated.

Mortgage markets improved last week, carried by the same stories that have led markets better since April. Worries of a Eurozone sovereign debt default mounted, and the U.S. economy’s revival showed itself to be slower than originally anticipated.

In Greece, the nation readied itself for its second bailout in two years. The austerity measures of last year have not worked as planned. There are concerns that a default would lead to contagion, delivering the Euro region into an economic tailspin.

These fears spurred a flight-to-quality in bond circles to the benefit of U.S. mortgage rate shoppers.

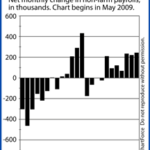

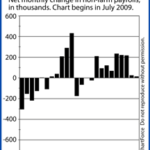

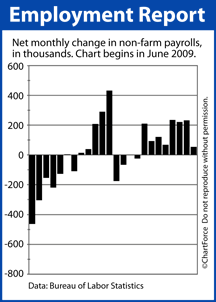

In addition, last week’s U.S. jobs data fell short of expectations, giving another boost to mortgage markets.

There were 3 weak reports:

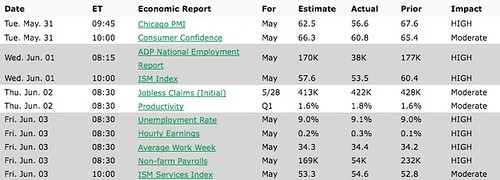

- ADP showed 38,000 private-sector jobs created in May. Analysts expected 170,000.

- The Department of Labor showed 422,000 Initial Jobless Claims. Analysts expected 415,000.

- The Bureau of Labor Statistics showed 54,000 jobs created in May. Analysts expected 150,000.

Each of these data points underscores the fragile nature of the U.S. recovery, and the weaker-than-expected readings helped mortgage rates improve.

It’s the sixth week of 7 that mortgage rates in Ankeny have improved, setting the stage for a new wave of refinances.

Specifically, What Did Those Reports Say?

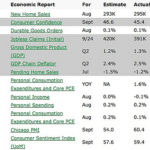

Each week, I put up an economic calendar of news coming out that following week. Here’s the what actually happened with those reports last week:

What Impacts Mortgage Rates?

If you’re looking to purchase or refinance a home, it’s important to know what moves mortgage rates. There are normally two major things that impact the direction:

- Economic News. (Like the calendar above).

- International News. (major events, pending legislation, war related news, etc).

- Stock Market. (Money flows from equities (stocks) to bonds when it seeks shelter).

What Are Rates Based On?

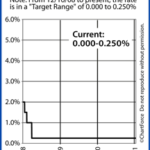

It’s been mentioned before, but as a common reminder – mortgage rates are only based on one thing, Mortgage Backed Securities (MBS). The only way you have access to these is through live bond quotes.

Looking For Mortgage Rates?

If you’re looking for specifically what mortgage rates are doing, I’d be happy to help with a custom rate quote. Each scenario is different (there are 27 different factors a mortgage rate is determined by). If you or someone you currently know are looking for a mortgage, I’m here to help!

Information without obligation. That’s my policy. If you like what you hear, my team and I would love to help you out with your mortgage! Our contact information is on the top right hand side of this page!