Only 2nd Raise in Rates Over the Past 8 Weeks

Mortgage markets moved in feverish fashion last week, changing with extreme frequency, and eventually ending slightly worse on the week. Conforming mortgage rates fell to a 6-month low Wednesday but, by Friday, they had retreated higher.

Last week marked just the second time in 8 weeks that rates in Ankeny increased. During that span, Freddie Mac reports that mortgage rates have dropped 42 basis points, or 0.42%.

That equates to a monthly savings of $25.24 per $100,000 borrowed.

One reason why mortgage rates have been dropping is that the economy is growing more slowly than projected. In a speech last week, Federal Reserve Chairman Ben Bernanke described the U.S. recovery as “frustratingly slow”. In a separate speech, another Federal Reserve President, William Dudley, categorized the recovery as “subpar”.

Economic weakness tends to promote a low mortgage rate environment as equity markets sell off and investors seek safety of principal. Indeed, the Dow Jones Industrial Average fell for the 6th straight week, its longest losing streak since 2002.

Mortgage rates were also helped by ongoing uncertainty in Greece. The nation remains at-risk for default, and that’s spurring a bond market to flight-to-quality which benefits the U.S. mortgage market, too.

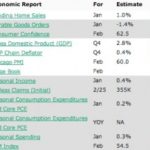

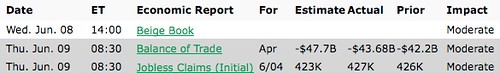

Specifically, What Did Those Reports Say?

Each week, I put up an economic calendar of news coming out that following week. Here’s the what actually happened with those reports last week:

What Impacts Mortgage Rates?

If you’re looking to purchase or refinance a home, it’s important to know what moves mortgage rates. There are normally two major things that impact the direction:

- Economic News. (Like the calendar above).

- International News. (major events, pending legislation, war related news, etc).

- Stock Market. (Money flows from equities (stocks) to bonds when it seeks shelter).

What Are Rates Based On?

It’s been mentioned before, but as a common reminder – mortgage rates are only based on one thing, Mortgage Backed Securities (MBS). The only way you have access to these is through live bond quotes.

Looking For Mortgage Rates?

If you’re looking for specifically what mortgage rates are doing, I’d be happy to help with a custom rate quote. Each scenario is different (there are 27 different factors a mortgage rate is determined by). If you or someone you currently know are looking for a mortgage, I’m here to help!

Information without obligation. That’s my policy. If you like what you hear, my team and I would love to help you out with your mortgage! Our contact information is on the top right hand side of this page!