Rates Fell to an All Time Low on Wednesday

The combination of global economic uncertainty plus a dour outlook from the Federal Reserve pushed mortgage bonds to highs for 2011, and drove mortgage rates below their all-time lows.

The combination of global economic uncertainty plus a dour outlook from the Federal Reserve pushed mortgage bonds to highs for 2011, and drove mortgage rates below their all-time lows.

Bonds were volatile, driven by the stock market’s gyrations.

On 4 consecutive days, the Dow Jones Industrial Average moved by more than 400 points. Rate shoppers in Iowa had no choice but to go along for the ride.

The week began with the market’s reaction to Standard & Poor’s U.S. credit rating downgrade. Mortgage bonds caught a boost on the news, and pushing rates lower throughout the day.

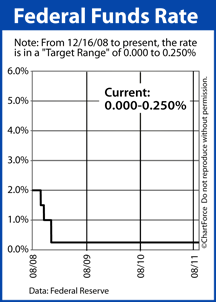

Tuesday, rates idled ahead of the Federal Open Market Committee meeting. There was speculation that the Federal Reserve would introduce a new round of economic stimulus but that didn’t happen. Instead, the Fed pledged to keep the Fed Funds Rate in its current range near zero percent until mid-2013, at least.

Mortgage rates dropped on the announcement and continued to drop until they fell to their lowest levels of the year — and of all-time — late Wednesday afternoon.

This proved to be the lowest rates of the week.

Thursday and Friday were marked by better-than-expected jobless figures and an improving Retail Sales number. Mortgage rates rose slightly.

Specifically, What Did Those Reports Say?

Each week, I put up an economic calendar of news coming out that following week. Here’s the what actually happened with those reports last week:

What Impacts Mortgage Rates?

If you’re looking to purchase or refinance a home, it’s important to know what moves mortgage rates. There are normally two major things that impact the direction:

- Economic News. (Like the calendar above).

- International News. (major events, pending legislation, war related news, etc).

- Stock Market. (Money flows from equities (stocks) to bonds when it seeks shelter).

What Are Rates Based On?

It’s been mentioned before, but as a common reminder – mortgage rates are only based on one thing, Mortgage Backed Securities (MBS). The only way you have access to these is through live bond quotes.

Looking For Mortgage Rates?

If you’re looking for specifically what mortgage rates are doing, I’d be happy to help with a custom rate quote. Each scenario is different (there are 27 different factors a mortgage rate is determined by). If you or someone you currently know are looking for a mortgage, I’m here to help!

Information without obligation. That’s my policy. If you like what you hear, my team and I would love to help you out with your mortgage! Our contact information is on the top right hand side of this page!