Full Calendar of Data Set to Release

With a full slate of economic data, because of Labor Day, bond markets will be light on volume. When volume is light, pricing gets volatile.

With a full slate of economic data, because of Labor Day, bond markets will be light on volume. When volume is light, pricing gets volatile.

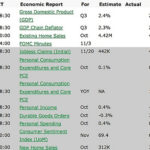

The week’s calendar of data includes:

- Monday : Pending Home Sales Index; Personal Income and Outlays

- Tuesday : FOMC Minutes; Fed President Kocherlakota speaks

- Wednesday : Factory Orders

- Thursday : Jobless Claims; ISM Manufacturing Index

- Friday : Non-Farm Payrolls

Of all the reports, though, it’s Friday’s Non-Farm Payrolls that might move mortgage markets the most.

Jobs are Crucial

If the jobs report shows more jobs created than expected, or a positive forward trend, expect bond markets to fall, pushing mortgage rates up. On the other hand, if the jobs report is soft, mortgage rates may improve.

We can’t know what rates in Ankeny will do on any given day, so the best strategy for a shopper is to shop with purpose. Know what you want, and be ready to lock when you see it.

If you wait too long, the rate will be gone.

Why Am I Posting A Calendar?

I provide this weekly news update because too often when we’re shopping around, we ask the wrong questions. The first thing you’ve got to have your antenna up on is economic news if you want to have any idea what direction rates are moving.

As a Consumer, How Do You Keep Posted on the News?

I’ll do my best to keep you posted throughout the week via Twitter. If you’re interested in finding out more about what effects mortgage rates and which direction they’re headed, feel free to follow me!

Work With Mortgage Professionals In The Advice Business

It’s important to recognize that advice is extremely valuable when looking for a mortgage. The right advice can literally save you thousands of dollars, while the wrong advice can cost you the same. Some mortgage professionals really don’t know what mortgage rates are based on, period. If you want to get the best deal, having a professional that can give you that type of advice is extremely important.

So You Say, What Are Mortgage Rates Currently?

I get this question all too often. If I’m being fair.. and honest (which is my policy). I would be doing you a huge disservice to just quote a rate.

Truth be told, there are literally 27 different factors that go into a custom rate quote. There are also thousands of programs (constantly changing as well). It’s extremely important that you are educated on what is available and most importantly what is the best mortgage plan for you to personally implement.

It’s natural to have a list of questions. I’d love to help work through them with you and educate you on what you need to know about the mortgage process. I can help with everything from how to pre-qualified to what to do after closing (where I will continue working for you)!

It’s what we do, and it would be my honor to add you to our list of raving fan clients. If you’re currently looking for a mortgage loan or know someone that might have questions about one, please have them contact me. I’d be happy to assist them. It’s literally what I love doing! I promise to take great care.