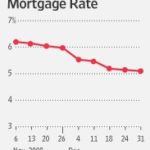

Lower the Rate, Higher the Cost

With mortgage rates at all-time lows, you may be asking “Is now a good time to refinance?”. This short interview from NBC’s The Today Show offers good insight.

Refinancing a mortgage is about more than just “low rates”. For example, there are costs associated with giving a new mortgage and even with the average, 30-year fixed rate mortgage near 4 percent, the costs of a such a move can outweigh the benefits — both in the short- and long-term.

The video originally ran in September when mortgage rates averaged 4.09%. Rates are different today, but the offered advice remains relevant.

Some of the key points raised include :

- The lowest rates come with the highest costs. Consider a slightly higher-rate option from your bank.

- Falling home values may make it harder to qualify for a refinance in the future. Your best time to act may be now.

- If you’re many years into a 30-year loan, you can consider switching to a 15-year mortgage to avoid “resetting” your term.

And, lastly, the interviewee makes a strong point that your refinance should save you enough money to make paying the closing costs “worth it”. Make sure the break-even point on your closing costs versus your monthly savings occurs within a reasonable time frame.

At 4 minutes, the The Today Show video is short, but dense with quality information. For follow-up on whether a refinance makes sense for your situation, be sure to talk with your loan officer.