When Stock Market Rallies, Rates Suffer

Mortgage markets worsened last week on renewed optimism from the Eurozone, additional evidence of a U.S. economic recovery, and ongoing strength in housing.

The action sparked a stock market rally at the expense of mortgage bonds, sending conforming and FHA mortgage rates meaningfully higher for the first time in more than 2 months.

Markets closed early Friday and remained closed Monday. When they re-open today, conforming mortgage rates will already have bounced off last week’s new, all-time lows.

As reported by Freddie Mac’s weekly mortgage rate survey, the average 30-year fixed rate mortgage fell to 3.91 percent nationwide, with an accompanying 0.7 discount points plus closing costs. 1 discount point is equal to 1 percent of your loan size such that 1 discount point on a $100,000 loan is equal to $1,000.

It’s not just the conventional 30-year fixed that made new lows last week, either. All of Freddie Mac’s reported rates fell to new, all-time lows.

- 30-year fixed : 3.91% with 0.7 discount points

- 15-year fixed : 3.21% with 0.8 discount points

- 5-year ARM : 2.85% with 0.6 discount points

These rates are no longer valid, however. FHA mortgage rates rose slightly last week, too.

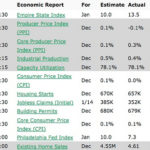

Specifically, What Did Those Reports Say?

Each week, I put up an economic calendar of news coming out that following week. Here’s the what actually happened with those reports last week:

What Impacts Mortgage Rates?

If you’re looking to purchase or refinance a home, it’s important to know what moves mortgage rates. There are normally two major things that impact the direction:

- Economic News. (Like the calendar above).

- International News. (major events, pending legislation, war related news, etc).

- Stock Market. (Money flows from equities (stocks) to bonds when it seeks shelter).

What Are Rates Based On?

It’s been mentioned before, but as a common reminder – mortgage rates are only based on one thing, Mortgage Backed Securities (MBS). The only way you have access to these is through live bond quotes.

Looking For Mortgage Rates?

If you’re looking for specifically what mortgage rates are doing, I’d be happy to help with a custom rate quote. Each scenario is different (there are 27 different factors a mortgage rate is determined by). If you or someone you currently know are looking for a mortgage, I’m here to help!

Information without obligation. That’s my policy. If you like what you hear, my team and I would love to help you out with your mortgage! Our contact information is on the top right hand side of this page!