One Half of a Million Jobs

Yes, in November the US lost 533,000 jobs. This was the largest increase of unemployment since 1973. Probably not a huge shocker overall, and that’s likely why mortgage rates didn’t move a whole lot on Friday. See, normally the uglier the news, the better mortgage rates do. However, the markets were expecting a stinker of a report. Therefore there wasn’t a huge impact in the mortgage backed security bond market (this is what mortgage rates are based on).

Yes, in November the US lost 533,000 jobs. This was the largest increase of unemployment since 1973. Probably not a huge shocker overall, and that’s likely why mortgage rates didn’t move a whole lot on Friday. See, normally the uglier the news, the better mortgage rates do. However, the markets were expecting a stinker of a report. Therefore there wasn’t a huge impact in the mortgage backed security bond market (this is what mortgage rates are based on).

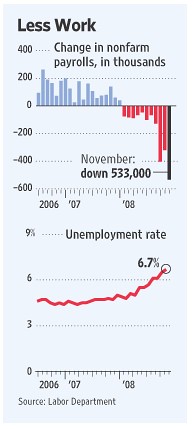

Getting back to the raw report, unemployment is obviously on the rise as you can see in the chart here on the right. It has also been estimated that unemployment may rise (nationally) to as much as 8 or 9%. It’s safe to say that we haven’t seen the worst yet.

Important to Consider the Actual Statistical Significance

It’s easy to say that this is the largest decline since 1973. Let’s be honest thought, the job force is MUCH larger now than it was in 1973. Specifically, 75% larger. I don’t want to discount the severity of our current economic situation, but let’s not discount the large disconnect between Friday’s job losses and those we saw in 1973.

God forbid we actually see the same percentage share job loss that we did back then, then we’ll have something to really talk about.

Planning For What May Happen

Without a doubt this is a very scary time. For many readers (including myself) this may be the first time you’ve personally weathered an economic storm such as this. It’s important to plan for what may happen in your personal life.

Have you set aside money in an emergency cash fund? If you haven’t started tightening your budget, you should. If you don’t have 6-12 months of expenses set aside right now, you should really consider making that happen. You never know what is around the corner.

I don’t mean to be a doom and gloom guy, but I honestly feel like it’s my responsibility to share this type of information. If you haven’t looked at all of your options on how to increase cash flow, you should. I’d be happy to help. Just drop me a line. I know people.

Chart Found at Wall Street Journal