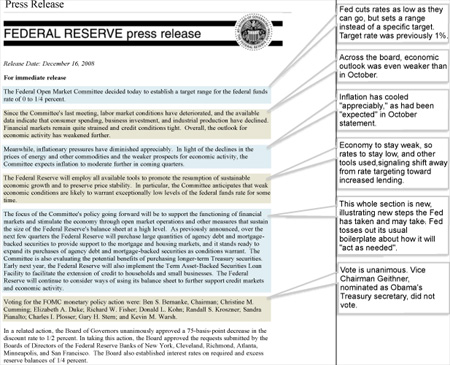

The Federal Open Market Committee voted to cut the Fed Funds Rate by at least three-quarters percent today. The benchmark rate now rests in a range of 0.000-0.250 percent (yea, that hasn’t happened before).

In its press release, the FOMC identified three key economic sectors in which activity has weakened since October. The FOMC noted that:

- The U.S. job market is deteriorating

- Consumer spending levels are falling

- Business investment is contracting nationwide

The Fed intends its rate cut to provide stimulate to each of these areas.

In addition, the voting members of the FOMC singled out inflation as less of an immediate threat to the economy. This is an important admission because it’s well-known that cuts to the Fed Funds Rate can spark inflation. Rapidly falling oil prices and commodity costs, therefore, likely paved the way for today’s historic cut.

In its announcement to markets, the Fed gave The People what they wanted — a reassurance that the policy-making group would “employ all available tools” to help turnaround the economy. Lowering the Fed Funds Rate to an all-time low is one such step; its plan to purchase mortgage-backed debt in the open market is another.

After the announcement, stock markets rallied and mortgage bonds did, too. Rates ended the day slightly lower. Much more to likely come. To see progress as it happens, follow me on Twitter.

Main Source Kudos

Parsing the Fed Statement

The Wall Street Journal Online

December 16, 2008

http://online.wsj.com/internal/mdc/info-fedparse0812.html