The Big Question

“Would You Like to Save 15 percent with today’s purchase? It will only take 60 seconds.”

Holiday shopping is now in season. Have you heard this phrase yet? More importantly, do you realize how these small store credit cards impact your credit score?

As a mortgage professional, I think about this all of the time. But let me share the dirty truth about this tricky little promotion. That 15 percent off of today’s purchase could cost you thousands of dollars in the future, and we’re not just talking about the 18 percent annual percentage rate they charge you. That’s just icing on the cake.

Your Credit Score

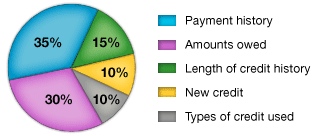

Your credit score is made up of five parts:

The decision to open up a store card impacts two of these categories directly, and will affect the other three in the future.

Immediate Impact

As soon as you open a store credit card, you are changing the “new credit” and “length of credit history.” That’s 25 percent of your credit score that you’re impacting with your 15 percent savings on TODAY’S PURCHASE. Effectively, you’re bringing down the average age of your accounts and looking like you’re hard up for credit – especially if you are applying for numerous credit card offers.

Do the math: Save 15 percent on today’s purchase for a 25 percent impact on your credit score. I wish I could tell you the exact impact your actual credit score, but since credit scoring is a ninja art, I cannot. What I can tell you is that it will likely impact you more than 20 points. That’s a lot.

When Your Bad Decision REALLY Hits Your Pocketbook

Let’s say you sign up for that credit card in the store to save the whopping 15 percent. Two months later, you decide you want to take advantage of this killer $7,500 tax credit that is available for first-time home buyers. Since your credit score fell, your interest rate on the mortgage is slightly higher (let’s say .25 percent). The $200,000 loan you’re getting now costs you $32 more each month. That might not seem like much until you figure out that is $11,520 over 30 years. Chump change, right?

Next time someone offers you a store credit card with some sweet discounts, think about it. It’s not as sweet as you think. No matter how much you want that big Christmas sweater for your party.