It’s Not Always What It Seems

With respect to mortgage rates, you can’t always believe what you read in the papers. Or what you see. The folks who write the articles are only as well informed as the sources that gave them the information.

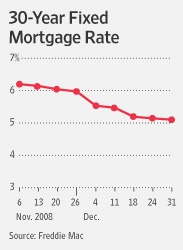

A great example is the chart here on the right.

Published by Freddie Mac, it shows the 30-year fixed mortgage’s “going rate” as reported by the nation’s mortgage lenders. On December 30, 2008, that rate was 5.1 percent.

But 5.1 percent is only half of the relevant information. There’s a mandated fee schedule that accompanies the Freddie Mac-reported rate survey. Notice this chart doesn’t detail the fee schedule.

Sort of misleading, right?

The Fees Aren’t Always Mentioned In These Articles

Currently, the published fee (per: Freddie Mac) required to get a 5.1 percent mortgage rates is 0.7% of the borrowed amount, or $700 per $100,000 borrowed. This fee is more commonly known as “points” and versus last year, it’s nearly doubled from 0.4 points. Interesting, right?

So, yes, conforming mortgage rates are low and they have fallen near all-time lows but there’s more to the story than just the interest rate — there are the fees that go with them, too.

Make Informed Decisions

Mortgage rates and loan fees often move in opposite directions so to get lower rates, consider paying additional points. Conversely, to face fewer fees, accept a higher rate. It’s a trade-off and your loan officer can help you best understand the choices. You can read my extremely popular blog post on deciding if paying points is right for you can be found here.

(Photo Kudos: The Wall Street Journal)