Bad News Happens

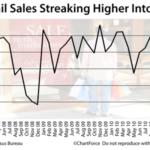

After a very weak holiday shopping season, annual retail sales declined in 2008.

Interestingly enough, It marks the first annual Retail Sales decline since the government started tracking it 40 years ago.

Interestingly enough, It marks the first annual Retail Sales decline since the government started tracking it 40 years ago.

It also confirms that the U.S. economy is suffering through a deeper recession than we previously thought. Consumers pulling back in spending (especially in December) how cautious Americans are with their cash today.

In a strange sort of way, all of this may end up being good news for Spring home buyers. Lucky you.

Making Lemons Out of Lemonade

Since Retail Sales are a reflection of consumer spending, a pullback like this helps to keep the economy in slow gear. It doesn’t sound sexy, but it counters the inflationary impact of our government’s spending their way out of our current economic situation. As you’ll remember from previous posts, Inflation causes mortgage rates to rise. Since there is no inflation mortgage rates stay low.

Also noteworthy, it’s earnings season on Wall Street. Unfortunately (or fortunately…) weak corporate guidance has spurred a 6-day decline in the Dow Jones Industrial Average. As investors money leaves the stock market, they put their money in the safer world of bonds. This includes mortgage bonds, of course, which further pressures rates lower.

As you can see, economic weakness can be the friend of a person in need of a new home loan. If you’re looking for a loan (both as a purchase or refinance) you’re entering the market at the right time.

(Photo Kudos: The Wall Street Journal Online)