What’s The Fed Up To?

Today, The Federal Open Market Committee voted to leave the Fed Funds Rate unchanged. The Fed Funds Rate (FFR) remains within a target range of 0.000-0.250 percent.

Talking Points of Today’s Statement

In today’s press release, the FOMC reiterated most of the key points from its December 2008 statement, including:

- The U.S. employment outlook continues to deteriorate

- Consumers and businesses continue to cut spending

- The housing sector is still showing weakness

In addition, the FOMC addressed the “extremely tight” credit conditions for U.S. households and business, even as it said some financial markets are showing signs of improvement.

For Americans needing new mortgages or other forms of credit, it may mean that getting approved gets easier sometime late this year. Again, may mean so.

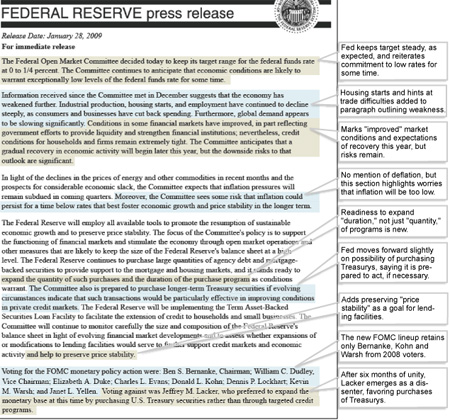

The Full WSJ Parsing of the Fed

The Fed’s Tool Belt

It’s important to also mention that the Fed’s press release again mentioned the policy-setting group’s plan to “employ all available tools” to promote economic growth. An example of this is the purchasing of mortgage-backed debt, which has helped fuel the current Refi Boom. In today’s statement, the Fed indicated they’re willing to extend the program beyond the initial $500 billion if it’s needed.

Chances of Inflation Long Term

For all of the good these moves will do, there is a downside.

Buying securities like mortgage backed securities cost big money and the Fed — literally — comes up with the cash by printing it. With the extra supply of money, the U.S. dollar devalues. If it goes without being considered, it can cause the Fed’s plan to backfire. Inflation could be harsh. The Fed has mentioned they are aware of these risks and has pledged to monitoring them closely.

Overall, mortgage rates worsened slightly today after the Fed’s statement. I think tomorrow (Thursday) will be the real decision maker.

(Photo Kudos: Parsing the Fed Statement, WSJ)