Delinquencies Are On The Rise

Mortgage delinquencies are on the rise nationwide, but the news may not be as bad as it appears at first glance. Yes, keep reading.

The Source

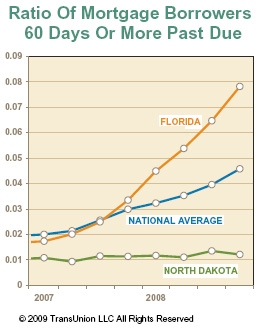

Using anonymous data from its national credit database, TransUnion reports that 4.58 percent of American homeowners were at least 60 days past due on mortgage payments last quarter.

Comparing the statistic to the data from a year ago, the credit reporting agency goes on to say that mortgage delinquencies are up 53 percent.

Although it’s still fair, the comparison carries a distinct, negative connotation because if we flip the data to be positive, the statistics don’t seem nearly as bad.

Looking at The Good In the Bad

Consider that in the last quarter of 2008, 4.58 percent of homeowners were delinquent on their respective mortgages. The positive sign, therefore, is that 95.42 percent of homeowners were not delinquent on their home loans.

Dissecting the Data

Furthermore, in looking at TransUnion’s data for the 5 largest states in the Union, it’s clear that the national delinquency rate is being thrown by California and Florida. New York and Texas, for example, exhibit delinquency rates below the national 4.58 percent marker.

As you can see in the graph, North Dakota’s delinquency rate hovers near 1 percent. Unfortunately the data wasn’t graphed with Iowa, otherwise I would have included it. Just wanted to point out the obvious next question.

Headlines are designed to attract eyeballs and nothing else. To get the complete story, therefore — the real story — it never hurts to dig a little deeper into the facts.

(Image Kudos: TransUnion)