Surprise! Mortgage Rates Improve!

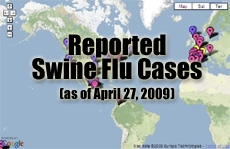

Monday, mortgage markets improved with the new news of new Swine Flu cases.

It’s a classic example of ‘Safe Haven buying’ and today’s rate shoppers will see the benefits.

Mortgage rates improved about 0.125 percent on Monday alone.

Why’s It Happen?

It’s not an official term, but “Safe Haven buying” is when large numbers of investors move money away from riskier investments and toward safer ones. As a general rule in Safe Haven buying, stocks sell off and bonds make big gains, including the bonds that mortgage rates are based on, mortgage-backed bonds.

Fears that a global Swine Flu outbreak would slow the global recovery is a major reason why mortgage rates improved Monday.

Shifting risk is a common reaction on Wall Street when unexpected events like this occur. Because the future is more uncertain, traders often like to play it safe. This is what “Safe Haven buying” is all about.

Nobody Saw It Coming

If nothing else, Monday’s mortgage rate action reminds us that the biggest influences on the market are often not the events we can prepare for. It’s the events we never see coming.

This morning, with known Swine Flu cases spreading to across the world to places such as Asia and resulting in a Phase 4 Alert from the World Health Organization, Safe Haven buying is continuing. However, with the Federal Reserve meeting today, markets could be ripe for a correction. Keep your eyes on the market, things could move quickly.

If you’re looking for updates on the fly, feel free to follow me on Twitter. If you’re only reading our blog, you’re missing some of the important facts!

(Image Kudos: Niman and Google Maps)