Volatility Will Continue, Based on a Unique News

This week, markets will digest a host of new data. Rate shoppers can expect the volatility to continue.

Monday afternoon, Auto and Truck Sales data is released. We normally don’t track this report, but because of the auto industry’s role in the economy right now, strong numbers should lead to a mortgage bond sell-off, likely pushing mortgage rates higher.

Where’s the Consumer’s Money Going?

Then, Tuesday, the Personal Income and Personal Spending report is released as well as the Pending Home Sales Index. Again, strength in the numbers would likely result in higher mortgage rates.

Jobs, Job and More Jobs

Thursday, Initial Jobless Claims will get the market’s attention. The data has been trending lower over the past two months and, last week, the rolling, 4-week average posted its lowest mark since January. A reversal in the trend would likely boost the mortgage markets, helping rates to fall.

Friday, the jobs report is due.

With unemployment close to 10 percent nationwide & more than 3 million jobs lost this year, investors will respond to “less weak” data with enthusiasm, a bad result for rate shoppers. No matter what the data says, it’s sure to move markets.

You Can Stay Updated!

I’ll be following things as they happen with live mortgage bond quotes and do what I can to keep everyone informed with live updates through Twitter.

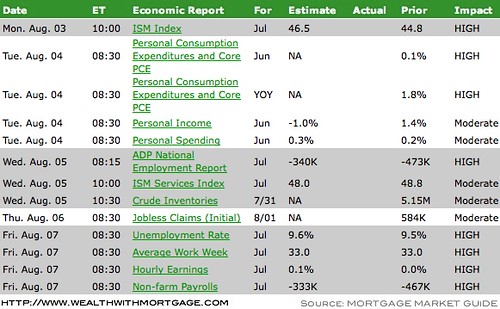

Here’s this week’s economic calendar:

As a Consumer, How Do You Keep Posted on the News?

I’ll do my best to keep you posted throughout the week via Twitter. If you’re interested in finding out more about what effects mortgage rates and which direction they’re headed, feel free to follow me!

Work With Mortgage Professionals In The Advice Business

It’s important to recognize that advice is extremely valuable when looking for a mortgage. The right advice can literally save you thousands of dollars, while the wrong advice can cost you the same. Some mortgage professionals really don’t know what mortgage rates are based on, period. If you want to get the best deal, having a professional that can give you that type of advice is extremely important.

Why Am I Posting A Calendar?

I provide this weekly news update because too often when we’re shopping around, we ask the wrong questions. The first thing you’ve got to have your antenna up on is economic news if you want to have any idea what direction rates are moving.

So You Say, What Are Mortgage Rates Currently?

I get this question all too often. If I’m being fair.. and honest (which is my policy). I would be doing you a huge disservice to just quote a rate.

Truth be told, there are literally 27 different factors that go into a custom rate quote. There are also thousands of programs (constantly changing as well). It’s extremely important that you are educated on what is available and most importantly what is the best mortgage plan for you to personally implement.

It’s natural to have a list of questions. I’d love to help work through them with you and educate you on what you need to know about the mortgage process. I can help with everything from how to pre-qualified to what to do after closing (where I will continue working for you)!

It’s what we do, and it would be my honor to add you to our list of raving fan clients. If you’re currently looking for a mortgage loan or know someone that might have questions about one, please have them contact me. I’d be happy to assist them. It’s literally what I love doing! I promise to take great care.