National Stats Don’t Necessarily Reflect Local Changes

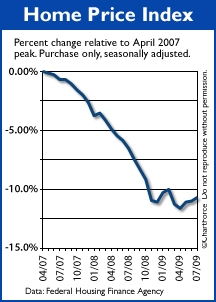

As reported by the government, home prices are rising nationwide, up 0.3 percent in July.

Furthermore, versus November 2008, the Home Price Index has clawed back to unchanged.

The housing market appears to be holding its own.

However, we have to be careful about putting our full faith in the Federal Housing Finance Agency’s data. It’s somewhat flawed.

- The Home Price Index is a national statistic and all real estate is local

- The Home Price Index’s methodology specifically excludes key housing demographics

Key Exclusions Show Report Isn’t a Full Sample of the Market

As an obvious example, HPI only accounts for homes with Fannie Mae- or Freddie Mac-backed mortgage. Lately, the percentage of homes meeting that description is shrinking.

As FHA financing rises in popularity, Fannie and Freddie back far fewer loans than in the past. Furthermore, the HPI sample set also excludes newly-built homes and multi-unit properties.

Because of these exclusions, some analysts call the HPI incomplete. The same could be said of all home price metrics, however — including the venerable Case-Shiller Index.

Therefore, what should be of interest to today’s buyers and sellers is that all of “popular” home valuation models seem to be telling the same story — home prices have stopped falling and look like they’re beginning to rebound.

For a region-by-region breakdown of the Home Price Index, visit the FHFA website.