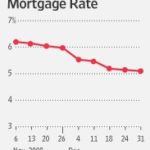

Mortgage markets were relatively flat last week during holiday-shortened trading. After starting the week with a Monday surge higher, mortgage rates settled down through Tuesday and remained somewhat flat into the early-close for New Year’s Eve.

Mortgage markets were relatively flat last week during holiday-shortened trading. After starting the week with a Monday surge higher, mortgage rates settled down through Tuesday and remained somewhat flat into the early-close for New Year’s Eve.

However, as compared to the 4-month low posted post-Thanksgiving, conforming mortgage pricing has now worsened by more than 300 basis points. In English, that means that a December 1 Iowa mortgage rate quoted with zero points is available today at a cost of 3 points.

1 “point” is equal to 1 percent of how much you borrow.

If you were shopping for homes or rates last month, you no doubt noticed that pricing zoomed higher to close out 2009. How 2010 starts is anyone’s guess. This week will hold the answer.

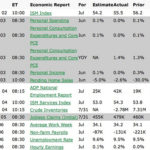

It’s a week light with data, but heavy on importance. The biggest news comes Friday in the form of the December employment report.

Last month, the Unemployment Rate fell for just the second time in 2 years and net job gains nearly turned positive. Both points were bad for mortgage rates because a weak economy has helped keep rates down. Evidence of improvement, therefore — at least according to Wall Street — is reason for reversal.

This month, analysts expect a net job gain of zero. If they get it, the psychological effect of the data should cause stock markets to rise and mortgage markets to sink.

A worsening market is bad for rates.

Other data to watch this week is Tuesday’s Pending Home Sales report and Wednesday’s FOMC November Minutes release. Both can forcefully impact markets and rates.

Today is January 4 — there’s a lot of 2010 to go. However, that won’t stop Wall Street from trying to figure it out. As the stock market rises and falls this week, the bond market will likely be in tow. Abrupt movements mean changing mortgage rates and we’ll see more of our fair share of it over the next few weeks.

If you’re quoted a mortgage rate this week that fits your budget, consider locking it in. Rates may fall in 2010, or they may not. It’s a gamble on which you don’t want on the wrong side because when rates do rise, they’re likely to rise quickly.

Markets can’t sustain rates like this in an expanding economy.