New Refinancing Opportunities Available

Conforming and FHA mortgage rates improved last week on the combination of weaker-than-expected economic data and new anti-banking rhetoric from the White House.

The S&P 500 shed nearly 4 percent in its worst weekly showing since October 2009 as all 10 sectors fell. As the money left stock markets, it made its way to bonds — including the mortgage-backed variety.

As a result, Iowa mortgage rates fell for the third straight week.

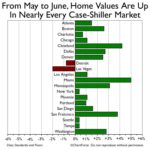

Since shedding 300 basis points in December, mortgage bond pricing has recovered a bit more than half of those losses. It’s helping with home affordability and opening new refinance opportunities in Des Moines and around the country.

Specifically, What Did Those Reports Say?

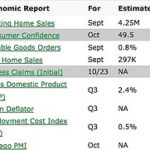

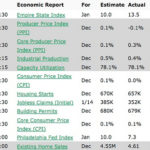

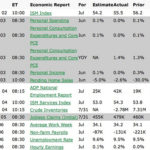

Each week, I put up an economic calendar of news coming out that following week. Here’s the what actually happened with those reports last week:

What Impacts Mortgage Rates?

If you’re looking to purchase or refinance a home, it’s important to know what moves mortgage rates. There are normally two major things that impact the direction:

- Economic News. (Like the calendar above).

- International News. (major events, pending legislation, war related news, etc).

- Stock Market. (Money flows from equities (stocks) to bonds when it seeks shelter).

What Are Rates Based On?

It’s been mentioned before, but as a common reminder – mortgage rates are only based on one thing, Mortgage Backed Securities (MBS). The only way you have access to these is through live bond quotes.

Looking For Mortgage Rates?

If you’re looking for specifically what mortgage rates are doing, I’d be happy to help with a custom rate quote. Each scenario is different (there are 27 different factors a mortgage rate is determined by). If you or someone you currently know are looking for a mortgage, I’m here to help!

Information without obligation. That’s my policy. If you like what you hear, my team and I would love to help you out with your mortgage!