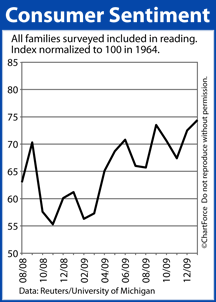

Consumer Confidence is at a Two Year High

Consumer Sentiment has been on the rise since last February and it’s something to which Des Moines home buyers should pay close attention.

The affordability of your next home may hinge on consumer confidence. Weird, right?

As the economy recovers from a near-recession, many of the elements of a full recovery are in place. Business investment is starting to show returns. household spending is increasing, and financial systems are gaining strength.

What’s missing from the recovery, though, is jobs growth. Another net 20,000 jobs were lost in January. Data like that hinders economic growth.

With that said, twenty-thousand jobs lost is a much better figure than the several hundred thousand that were shed per month throughout early-2009. But, keep in mind it’s still a net negative number. Not only does household income drop when Americans lose jobs but so does the average American’s confidence in his or her own economic future. It’s truly scary stuff.

Wall Street is Paying Close Attention

This is one reason why jobs growth is so closely watched by Wall Street — jobs are generally linked to higher confidence levels. People believe that confidence spurs consumer spending.

Consumer spending represents 70% of the U.S. economy.

As confidence rises, it could be good news for the economy, but bad news for home buyers. More spending expands the economy and, all things equal, that leads mortgage rates higher.

Same for home prices. More confidence means more buyers which, in turn, squeezes the supply-and-demand curve in favor of sellers.

Later this morning, the University of Michigan will release its February Consumer Sentiment survey. If the reading is higher-than-expected, prepare for mortgage rates to rise and home affordability to worsen.

If you’re wondering what mortgage rates are doing, you’re not alone. If you’d like to have more “hands on” attention to your mortgage shopping experience, I am currently taking new clients. Feel free to email me and we can discuss your loan options. Rates fluctuate, but we take a lot of the uncertainty out of the mortgage process.