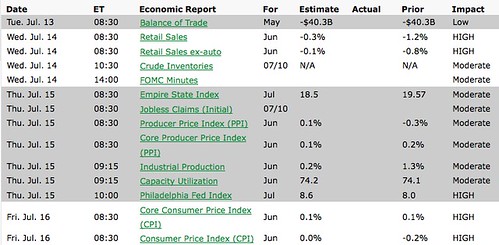

A LOT of Data Returns This Week

Expect movement. Data returns and rates could reverse quickly. Specifically, with inflation numbers are in play.

Expect movement. Data returns and rates could reverse quickly. Specifically, with inflation numbers are in play.

Remember, inflation is the enemy of mortgage rates.

The reason inflation is bad for mortgage rates is because mortgage rates based on the price of mortgage-backed bonds. When inflation pressures mount, the demand for mortgage-backed bonds wanes and that pushes bond prices down which, in turn, pushed bond yields (i.e. rates) up.

Believe it or not, there’s three pieces of inflation-related news this week.

The first inflation-related story is the Federal Reserve’s Wednesday release of the minutes from its last meeting. Now, when the Fed adjourned June 23, it said “underlying inflation has trended lower“. However, there was more to the conversation that what the FOMC released in its post-meeting statement.

Lock Your Rate, News Will Keep Coming!

Then, Thursday, the Producer Price Index is released. The Producer Price Index is a measure of business operating costs. When PPI is increasing, it means that “doing business” is more expensive — an inflationary situation. It’s inflationary because higher business costs are often absorbed by consumers in the form of higher prices for goods and services.

A rising PPI is usually bad for mortgage rates. Usually meaning, something could com out of right field and take the attention from traders.

Lastly, on Friday, the Consumer Price Index is released. The CPI measures the average American’s “cost of living”. Like PPI, when the Consumer Price Index is rising, mortgage rates tend to follow.

Other releases of import this week include Retail Sales and two consumer confidence surveys.

Last week, mortgage rates again made new all-time lows. If you haven’t checked with your loan officer about the possibility of a refinance, make that call this week. Mortgage rates can stay low for a long time, but they can’t stay low forever. Lock your rate while you can. As a reminder, I’d love to help you out. If you need someone to call, call me. All of my contact information is on the right hand side of this post!

You Can Stay Updated!

I’ll be following things as they happen with live mortgage bond quotes and do what I can to keep everyone informed with live updates through Twitter.

As a Consumer, How Do You Keep Posted on the News?

I’ll do my best to keep you posted throughout the week via Twitter. If you’re interested in finding out more about what effects mortgage rates and which direction they’re headed, feel free to follow me!

Work With Mortgage Professionals In The Advice Business

It’s important to recognize that advice is extremely valuable when looking for a mortgage. The right advice can literally save you thousands of dollars, while the wrong advice can cost you the same. Some mortgage professionals really don’t know what mortgage rates are based on, period. If you want to get the best deal, having a professional that can give you that type of advice is extremely important.

Why Am I Posting A Calendar?

I provide this weekly news update because too often when we’re shopping around, we ask the wrong questions. The first thing you’ve got to have your antenna up on is economic news if you want to have any idea what direction rates are moving.

So You Say, What Are Mortgage Rates Currently?

I get this question all too often. If I’m being fair.. and honest (which is my policy). I would be doing you a huge disservice to just quote a rate.

Truth be told, there are literally 27 different factors that go into a custom rate quote. There are also thousands of programs (constantly changing as well). It’s extremely important that you are educated on what is available and most importantly what is the best mortgage plan for you to personally implement.

It’s natural to have a list of questions. I’d love to help work through them with you and educate you on what you need to know about the mortgage process. I can help with everything from how to pre-qualified to what to do after closing (where I will continue working for you)!

It’s what we do, and it would be my honor to add you to our list of raving fan clients. If you’re currently looking for a mortgage loan or know someone that might have questions about one, please have them contact me. I’d be happy to assist them. It’s literally what I love doing! I promise to take great care.