How Do Adjustable Rate Mortgages Work? The Facts Might Surprise You.

How Do Adjustable Rate Mortgages Work? The Facts Might Surprise You.

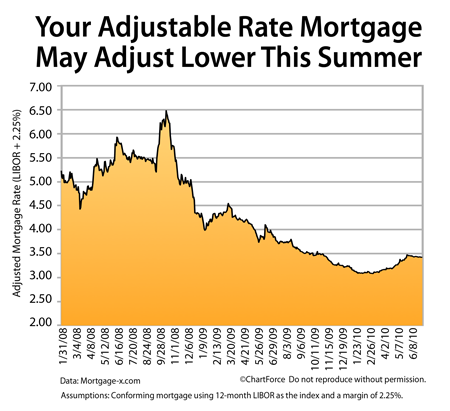

If your adjustable rate mortgage is going to adjust this year, don’t go rushing to refinance it just yet. Your soon-to-adjust mortgage rate may actually go lower. It’s related to the math behind the ARM.

Here’s the quick-and-dirty explanation.

Conventional, adjustable rate mortgages share a common life cycle:

- There’s a “starter period” in which the interest rate remains fixed

- There’s an initial adjustment period after the starter period called the “first adjustment”

- There’s a subsequent annual adjustment until the loan’s term expires — usually at Year 30.

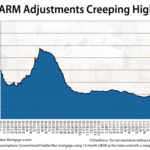

The starter period will vary between 1 and 10 years, but at the point of first adjustment, conventional ARMs become the same. A homeowner’s new, adjusted mortgage rate is determined by the sum of some constant, and a variable. The constant is most often 2.25% and the variable is most often the 12-month LIBOR.

What’s An Adjustment Look Like?

As a formula, the math looks like this:

(Adjusted Mortgage Rates) = (12-Month LIBOR) + (2.250 Percent)

LIBOR is an acronym standing for London Interbank Offered Rate. It’s the rate at which banks borrow money from each other and, lately, LIBOR has been low. As a result, adjusting mortgage rates have been low, too.

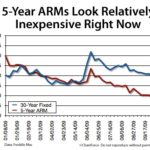

Believe it or not, last year 5-year ARMs were adjusting to 6 percent or higher. Today, they’re adjusting to 3.375%! Not too shabby.

Based on the math, it may be wise to just let your ARM adjust this year. Or, depending on how long you plan to stay in your home, consider a refinance to a new ARM. Starter rates on today’s adjustable rate mortgages are exceptionally low in Iowa, as are the rates for fixed rate loans.

Either way, talk to me about making a plan. With mortgage rates as low as they’ve ever been in history, you as a homeowner have some interesting options. Just don’t wait too long. LIBOR — and mortgage rates in general — are known to change quickly. If you’re ready to talk, please contact me at the information off to the right of this blog post! If you need help figuring out what your adjustable rate mortgage will be doing, I’d happy to help you figure it out. It beats hoping things don’t skyrocket.