The Common Financing Question

Which is better — a fixed-rate mortgage or an adjustable-rate mortgage? It’s a common question among home buyers and refinancing households in Iowa. Feel at ease though, it’s all easy to sort through.

Which is better — a fixed-rate mortgage or an adjustable-rate mortgage? It’s a common question among home buyers and refinancing households in Iowa. Feel at ease though, it’s all easy to sort through.

Fixed-rate mortgages give the certainty of a known, unchanging principal + interest payment for the life of the loan. This can help you with budget-setting and financial planning. Some homeowners say fixed-rate loans they offer “peace of mind”.

Adjustable-rate mortgages do not. In fact, they’re down-right scary to someone who wants predictability in their life.

After a pre-determined, introductory number of years, the initial interest rate on the note — sometimes given the negative name a”teaser rate” — moves up or down, depending on the existing market conditions. It then adjust again every 6 or 12 months thereafter until the loan is paid in full.

ARMs can adjust higher or lower so they are necessarily unpredictable long-term. However, if you can be comfortable with uncertainty like that, you’re often rewarded with a very low initial interest rate — much lower than a comparable fixed rate loan, anyway.

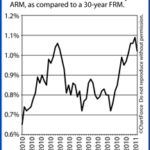

Freddie Mac’s weekly mortgage survey highlights this point. (See: Chart to the right.)

An ARM Loan Can Be Good for You If:

The interest rate gap between fixed-rate mortgages and adjustable-rate mortgages is growing. It peaked 2 weeks ago, but remains huge at 1.16 percentage points. That’s quite a lot.

On a $200,000 home loan, this 1.16 FRM/ARM spread yields a monthly principal + interest payment difference of $136, or $8,160 over 5 years, the typical initial “teaser” rate period.

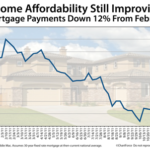

Savings like that can be compelling and may push you toward an adjustable rate loan if you are a numbers person.

You might also consider a 5-year ARM over a fixed-rate loan if any of these scenarios apply:

- You’re buying a new home with the intent to sell it within 5 years

- You’re currently financed with a 30-year fixed mortgage and have plans to sell the home within 5 years

- You’re interested in low payments, and are comfortable with longer-term payment uncertainty

Furthermore, homeowners whose existing ARMs are due for adjustment might want to refinance into a brand new ARM, if only to push the teaser rate period farther into the future.

Before choosing ARM over fixed, though, make sure you speak with your loan officer about how adjustable rate mortgages work, and their near- and long-term risks. The payment savings may be tempting, but with an ARM, the payments are never permanent. It’s all about suitability. If you need some help, reach out to me. I’d love to help you out. My phone number is on the right hand side of this post and you can also email me to run your questions by me (my email is Tyler (AT) TylerOsbyTeam (DOT) com) , and yes, I know it’s written down goofy — but that’s to avoid spam.

Either way you choose to proceed, know that with the right advice and some good understanding, it’s not a tough decision. Ultimately, you might end up going a different route than you initially thought.