Rates Down Overall for 2nd Straight Week

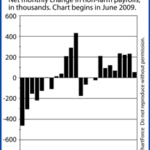

Mortgage markets improved last week as the Federal Reserve provided new market stimulus and the Eurozone continued to grapple with Greek’s sovereign debt issues.

Mortgage markets improved last week as the Federal Reserve provided new market stimulus and the Eurozone continued to grapple with Greek’s sovereign debt issues.

Conforming mortgage rates fell in Iowa last week overall, dropping for the second straight week.

For rate shoppers, the best day on which to lock a mortgage rate last week proved to be Thursday.

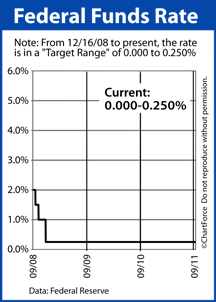

Fresh off the Federal Reserve’s Wednesday afternoon announcement that the group will launch a $400 billion program in support of longer-term bonds, mortgage rates fell. This occurred because mortgage rates are based on the price of mortgage-backed bonds, and mortgage bonds are a beneficiary of the Fed’s new program.

Those gains were short-lived, however, because Friday morning, when the market opened, mortgage bonds were deteriorated, and that momentum carried through to the afternoon.

By the time the markets closed for the weekend, nearly all of the Fed-led gains had been drained from mortgage bonds.

Within a matter of 48 hours, the average 30-year fixed-rate mortgage rates had plunged — then surged — 0.250 percent.

The speed at which rates changed underscores how tough it can be to shop for a mortgage these days. If you were quick on Thursday, you locked your rate at its low. If you “slept on it”, though, or even took too much time to think, you not only missed the best mortgage rates in more than 50 years, you missed it by entire quarter-percent.

On a $200,000 mortgage, that’s an approximately monthly payment difference of $30 per month.

Specifically, What Did Those Reports Say?

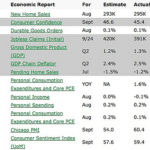

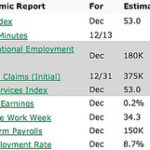

Each week, I put up an economic calendar of news coming out that following week. Here’s the what actually happened with those reports last week:

What Impacts Mortgage Rates?

If you’re looking to purchase or refinance a home, it’s important to know what moves mortgage rates. There are normally two major things that impact the direction:

- Economic News. (Like the calendar above).

- International News. (major events, pending legislation, war related news, etc).

- Stock Market. (Money flows from equities (stocks) to bonds when it seeks shelter).

What Are Rates Based On?

It’s been mentioned before, but as a common reminder – mortgage rates are only based on one thing, Mortgage Backed Securities (MBS). The only way you have access to these is through live bond quotes.

Looking For Mortgage Rates?

If you’re looking for specifically what mortgage rates are doing, I’d be happy to help with a custom rate quote. Each scenario is different (there are 27 different factors a mortgage rate is determined by). If you or someone you currently know are looking for a mortgage, I’m here to help!

Information without obligation. That’s my policy. If you like what you hear, my team and I would love to help you out with your mortgage! Our contact information is on the top right hand side of this page!