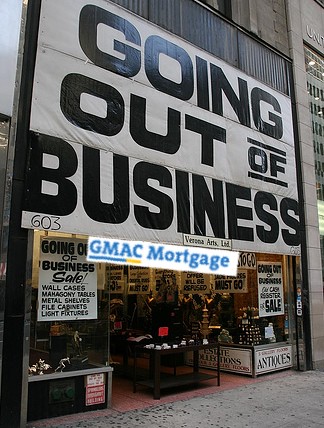

I hate it when a bank decides to exit the mortgage business. It’s no fun for many people, real people.

The News

Announced early this morning (Via Wall Street Journal E-mail Alert), GMAC announced they’d be cutting around 5,000 jobs due to mounting concerns of their mortgage division. They literally cut 60% of their work force in one call. GMAC was a mortgage lender that originated a lot of conventional (Fannie Mae and Freddie Mac) and Alt-A (outside of the box loans) mortgages. They had a lot of risk in the loans they’d originated and they lost 4.3 billion in 2007. Crazy.

Also interesting, ResCap (the mortgage division of GMAC) is now 51% owned by a private equity firm Cerberus Capital Management. They used to be wholly owned by General Motors. I guess you could say you could have seen this coming. At least I did. Still a shotty situation.

Who Does This Impact?

Today’s announcement of GMAC closing their retail mortgage division and wholesale mortgage division (a.k.a. Homecomings Financial) effects:

- Loan Officers (people like me)

- Office Managers

- Processors

- Underwriters

- Home Buyers That Were Counting On Their Approval

- Realtors Who Will Have to Explain What’s Happening

- Sellers Who May Have Troubles Closing.

- The Chain of Other Sellers.. Because If Your Buyer Falls Through, You Cannot Buy Your Next Home

I sort of went wild on capital letters of each word, huh?

What Should You Do If This Impacts You?

This post is NOT intended to scare current GMAC clients away from GMAC. I personally know a few GREAT mortgage professionals within the company. I am however suggesting you have a back-up plan. GMAC has explained that they will close any loans that have already been locked (or will be locked extremely soon). However, if you’re simply pre-approved with GMAC; you’ll likely need to find a new home for your loan. This would leave you with two options:

- You wait to see where your current mortgage professional ends up. (Many loan officers switch companies in a situation like this).

- You get a second opinion and have a strong contingency plan.

If I were in this position, I’d get a back-up pre-approval either way. If my mortgage professional from GMAC gets into a new company quickly enough to help me out, I’d likely go back to them. At least I’d have peace of mind!

Nice guy, aren’t I?

This Probably Won’t Be The Last One

Locally, we don’t have a ton of retail mortgage banking locations. Luckily. However, there are many other mortgage banks that are at risk of the same result as GMAC. I’m not pointing fingers or naming names, but count on it. There’s just too many losses mounting.

Let Me Know What I Can Do To Help

I want to be clear, I’m not a bottom feeder. I’m not contacting any Realtors to let them know about this tragic event. One thing I am doing however, is offering a back up plan to those who need it. Trust me, I know how stressful this can be for all parties and the last thing I want is problems with these deals closing.

We’re a stable mortgage lender (we all think we are….) and we’ll get you a back up option. It’s not a sexy situation, but let’s be professionals and get through this tough time.

My thoughts and prayers are with those who have been impacted with this massive layoff. There are a lot of great individuals that work out a GMAC. I wish them all the best and hope they fall on their feet and keep on running!

If you have a question about a deal, or just want a second opinion. Please, feel free to contact me.

Photo Kudos (Going Out Of Business) (GMAC, a registered trademark)

{ 1 comment… read it below or add one }

Hi Tyler !! I had my mortgage through GMAC. With all the talk of the Presidents’ mortgage help for home owners, Gmac did a number on me and my loan causing me to lose my home. I’m sure if GMAC had employees that knew the same info ( to tell me ), it might have turned out different. I, for one, am glad they’re O.O.B.