Mortgage Rate and Market Recap for the Week of September 1st – September 7th, 2008

Hope You’re Not One of the 6% of America.

Last week, we found out that un-employment is up to 6.1% now nationally! This is the highest we’ve seen since September of 2003.

Bad News = Good News for Mortgage Rates

As I’ve said before, mortagage rates tend to move downward on negative news. The reason why is a many investors move from stocks to bonds when things look ugly. Fixed returns just look a little more sexy when the job market looks like a pig with lipstick. That’s about what we’re looking at. At the end of the week, we were roughly .125% better in rates overall. Depending on what time of the week you looked into mortgage rates, it could have been much better than that. Again, it’s all about timing.

What Did Those Reports Say?

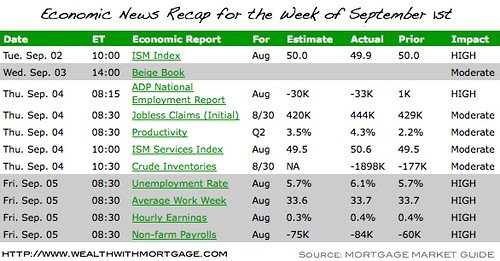

Each week, I put up an economic calendar of news coming out that following week. Here’s the results from last week:

(Click to Hugisize)

What Impacts Mortgage Rates?

If you’re looking to purchase or refinance a home, it’s important to know what moves mortgage rates. There are normally two major things that impact the direction:

- Economic News. (That’s these calendars).

- International News. (major events, war related, etc).

- Stock Market. (Money flows from equities (stocks) to bonds when it seeks shelter).

What Are Rates Based On?

It’s been mentioned before, but as a common reminder – mortgage rates are only based on one thing. Mortgage Backed Securities (MBS). The only way you have access to these is through live bond quotes.

Looking For Mortgage Rates?

If you’re looking for specifically what mortgage rates are doing, I’d be happy to help with a custom rate quote. Each scenario is different (there are 27 different factors a mortgage rate is determined by). If you or someone you currently know are looking for a mortgage, I’m here to help!

Information without obligation. That’s my policy. If you like what you hear, my team would love to help!