Mortgage Rate and Market Recap for the Week of October 6th – 10th, 2008

Banks Across the World Unite

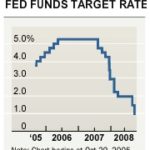

Banks across the world decided to cut their official rates by 1/2% on Wednesday. This is the largest move since the 1930s. It was a BIG BIG deal.

Inflation used to be the main concern, but after consideration, the cut was considered necessary to boost liquidity. You can read more about the (old) news here.

As a reminder, mortgage rates are not tied to the fed funds rate at all. In fact, they often tend to move the opposite direction. Inflation is normally the main culprit in making this happen. In this week’s case, it was the uncertainty that drove interest rates higher. About 3/4% higher specifically.

Floating your rate is risky. Last week is an extremely good example of that.

The Stock Market’s a Little Unpredictable

Understatement much? The stock market was a roller coaster last week. The volatility everyone saw in the stock market is a great example of what we’ve been seeing in the mortgage rate market. I know you can’t follow mortgage backed securities live like I can, but I warn you, it’s not for someone with a weak stomach!

I don’t really see this volatility going away anytime soon unfortunately. If you’re currently shopping for a mortgage, make sure you’re working with someone with LIVE mortgage backed securities quotes. With the right information, they should know they’re getting a new rate sheet before they even get one.

What Did Those Reports Say?

Each week, I put up an economic calendar of news coming out that following week. Here’s the what actually happened with those reports last week:

What Impacts Mortgage Rates?

If you’re looking to purchase or refinance a home, it’s important to know what moves mortgage rates. There are normally two major things that impact the direction:

- Economic News. (Like the calendar above).

- International News. (major events, pending legislation, war related news, etc).

- Stock Market. (Money flows from equities (stocks) to bonds when it seeks shelter).

What Are Rates Based On?

It’s been mentioned before, but as a common reminder – mortgage rates are only based on one thing. Mortgage Backed Securities (MBS). The only way you have access to these is through live bond quotes.

Looking For Mortgage Rates?

If you’re looking for specifically what mortgage rates are doing, I’d be happy to help with a custom rate quote. Each scenario is different (there are 27 different factors a mortgage rate is determined by). If you or someone you currently know are looking for a mortgage, I’m here to help!

Information without obligation. That’s my policy. If you like what you hear, my team would love to help!