Good News for U.S. Economy is Bad News for Rate Shoppers

Mortgage markets worsened last week as the Eurozone moved closer to a bailout agreement with Greece, and the U.S. economy displayed more signs of growth.

Rate shoppers should not be surprised that rates ticked north. Since mid-2011, weakness in Greece has helped keep mortgage rates low and the same is true for a weak U.S. economy. Wall Street has sought “safe assets” as protection from risk and that’s driven mortgage rates down.

Now, the safe haven buying that served to anchor low rates appears poised to reverse.

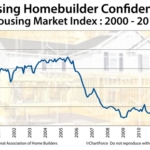

Last month, it was shown, consumer spending rose to record levels and the housing market surpassed analyst expectation again. Homebuilder confidence is now at a 4-year high and Single-Family Housing Starts topped one-half million units for the second straight month.

Conforming mortgage rates in Iowa rose for the first time in a month last week. Unfortunately, few shoppers knew because Freddie Mac’s weekly mortgage rate survey failed to capture the change. The survey deadline was Tuesday. Rates started rising Wednesday morning.

Freddie Mac’s weekly mortgage rate survey put the average 30-year fixed rate mortgage unchanged at 3.87% for borrowers willing to pay 0.8 discount points plus a full set of closing costs.

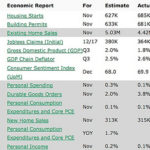

Specifically, What Did Those Reports Say?

Each week, I put up an economic calendar of news coming out that following week. Here’s the what actually happened with those reports last week:

What Impacts Mortgage Rates?

If you’re looking to purchase or refinance a home, it’s important to know what moves mortgage rates. There are normally two major things that impact the direction:

- Economic News. (Like the calendar above).

- International News. (major events, pending legislation, war related news, etc).

- Stock Market. (Money flows from equities (stocks) to bonds when it seeks shelter).

What Are Rates Based On?

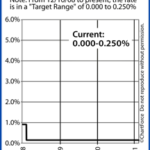

It’s been mentioned before, but as a common reminder – mortgage rates are only based on one thing, Mortgage Backed Securities (MBS). The only way you have access to these is through live bond quotes.

Looking For Mortgage Rates?

If you’re looking for specifically what mortgage rates are doing, I’d be happy to help with a custom rate quote. Each scenario is different (there are 27 different factors a mortgage rate is determined by). If you or someone you currently know are looking for a mortgage, I’m here to help!

Information without obligation. That’s my policy. If you like what you hear, my team and I would love to help you out with your mortgage! Our contact information is on the top right hand side of this page!