The Federal Open Market Committee (that’s Bernanke’s crew) ends its 2-day meeting at 2:15 P.M. ET today.

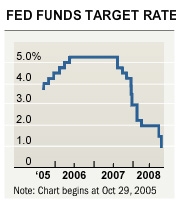

It’s widely expected that the FOMC will reduce the Fed Funds Rate by a half-percent to 0.500 percent.

It’s widely expected that the FOMC will reduce the Fed Funds Rate by a half-percent to 0.500 percent.

Fed Funds Rate cuts are meant to stimulate the economy by lowering borrowing costs for businesses and consumers. Interest rates on business credit lines and consumer credit cards are directly tied to the benchmark rate.

However, it won’t be what the Fed does today that will be as important as what the Fed says. And the markets are listening extremely closely.

See, this FOMC meeting was originally scheduled to last 1 day but on November 20, it was extended to 2. Presumably, the extra day was meant to give the FOMC a chance to review its options, but now it has the markets expecting “something big”.

Wall Street wants Bernanke to outline credit-extenstion plan for banks, businesses and consumers. It wants the Fed to strengthen markets to prevent the recession from become a depression. It wants action. Anything short of an explicit plan should push traders into ultra-safe U.S. Treasury bonds and that should lead mortgage rates higher.

If you are floating a mortgage rate today, it may make sense to lock prior to the Federal Open Market Committee’s press release. Expect volatility beginning around 2:00 P.M. ET today. Extreme volatility. Follow me on Twitter to see the ‘play-by-play’ on what the markets are doing.

If the history has any factor in predicting what will happen with today’s (likely) rate cut, you should see for yourself what has happened. I’m not saying inflation is much of a concern anymore — but some still think it is.

Photo Kudos: The Wall Street Journal