A Holiday Week Provides Little Movement In the Market

In a week defined by extremely low trading volume and lack of action, mortgage markets idled ahead of the holiday last week. Friday’s post-holiday action was even slower. I think people were sleeping their holiday meals off. Just my opinion.

After falling for two consecutive weeks, mortgage rates held flat last week.

Plenty Happened!

It’s somewhat surprising that mortgage rates didn’t change considering the flow of negative economic news last week:

It’s somewhat surprising that mortgage rates didn’t change considering the flow of negative economic news last week:

- Joblessness appears to be worsening

- Consumer spending sputtered

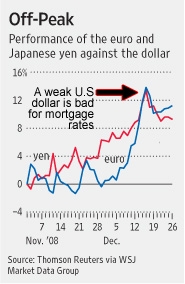

- The U.S. dollar is showing weakness

Lately, each of these elements has played a role in mortgage rate movement but it’s the last point that could throw home buyers and refinancing Americans a curve ball and leave them unhappy.

What’s Currency Got To Do With It?

It’s because of the relationship between mortgage rates and the strength of the U.S. Dollar.

All things equal, a strong dollar pressures mortgage rates lower whereas a weak dollar pressures mortgage rates up. And, because the dollar’s recent beat-down has been swift, it wouldn’t be unexpected to see similar mortgage market movement at any time.

Specifically, What Did Those Reports Say?

Each week, I put up an economic calendar of news coming out that following week. Here’s the what actually happened with those reports last week:

What Impacts Mortgage Rates?

If you’re looking to purchase or refinance a home, it’s important to know what moves mortgage rates. There are normally two major things that impact the direction:

- Economic News. (Like the calendar above).

- International News. (major events, pending legislation, war related news, etc).

- Stock Market. (Money flows from equities (stocks) to bonds when it seeks shelter).

What Are Rates Based On?

It’s been mentioned before, but as a common reminder – mortgage rates are only based on one thing. Mortgage Backed Securities (MBS). The only way you have access to these is through live bond quotes.

Looking For Mortgage Rates?

If you’re looking for specifically what mortgage rates are doing, I’d be happy to help with a custom rate quote. Each scenario is different (there are 27 different factors a mortgage rate is determined by). If you or someone you currently know are looking for a mortgage, I’m here to help!

Information without obligation. That’s my policy. If you like what you hear, my team would love to help!

(Image courtesy: The Wall Street Journal)