A Volatile First Full Week of 2009

In 2009’s first full week of trading, mortgage bond markets traded back-and-forth all week. Eventually they closed the week with an overall improvement.

Weekly mortgage rates also fell for the first time since mid-December.

Job Losses Pile Up

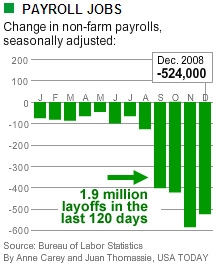

The most anticipated news of last week was Friday’s jobs report. According to government’s press release, the US economy shed another 524,000 jobs in December. This raises 2008’s total job losses to 2.065 million.

The press was quick to remind us that this is the largest annual job loss since 1945. You probably know me well enough now to see that I look beyond the headlines, today’s workforce is three times as large.

Inside The Fed

The release of the Fed’s minutes from its 2-day meeting in December came out Tuesday. In it, the Federal Reserve said that inflation should remain low through early-2010. This is good news for home buyers and homeowners because inflation is always linked to rising mortgage rates.

Specifically, What Did Those Reports Say?

Each week, I put up an economic calendar of news coming out that following week. Here’s the what actually happened with those reports last week:

What Impacts Mortgage Rates?

If you’re looking to purchase or refinance a home, it’s important to know what moves mortgage rates. There are normally two major things that impact the direction:

- Economic News. (Like the calendar above).

- International News. (major events, pending legislation, war related news, etc).

- Stock Market. (Money flows from equities (stocks) to bonds when it seeks shelter).

What Are Rates Based On?

It’s been mentioned before, but as a common reminder – mortgage rates are only based on one thing. Mortgage Backed Securities (MBS). The only way you have access to these is through live bond quotes.

Looking For Mortgage Rates?

If you’re looking for specifically what mortgage rates are doing, I’d be happy to help with a custom rate quote. Each scenario is different (there are 27 different factors a mortgage rate is determined by). If you or someone you currently know are looking for a mortgage, I’m here to help!

Information without obligation. That’s my policy. If you like what you hear, my team would love to help!

(Image Kudos: USA Today)