Sometimes It’s What You Don’t Expect

The speech was much anticipated, but it was what our new Treasury Secretary Tim Geithner didn’t say Tuesday that caused mortgage markets to improve.

Mostly it was because of “safe-haven” buying.

Safe-haven buying is what investors do when they’re afraid of losing money elsewhere. They move cash to the safest investments possible.

The Numbers Prove It

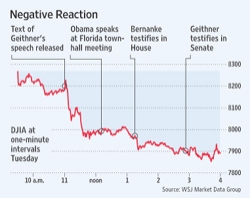

Look at Tuesday’s Dow Jones Index timeline. Stock markets were down some in the morning. Then, at 11:00 AM ET, in the moments immediately following the public release of Geither’s speech as text, stock market immediately plunged by about 2 percent.

As the speech was delivered live, markets fell by an additional 1 percent.

We Thought He Had Plans For Us

It’s not that Geithner’s speech was a bad one. It’s just that Wall Street was looking for a detailed plan that included fixes for banking, housing, and the economy overall. What we heard instead was an outline for a plan and a discussion about our current economy is.

Stock markets had been bid up last week in anticipation of a bailout. Yesterday’s action was the subsequent sell-off because economic uncertainty continues to linger.

It’s all good news for mortgage rate shoppers, though. When the dollars flew out of the stocks, they made their way towards safer, less-risky investments like mortgage bonds. And, because mortgage-backed bonds set the rate for conforming mortgages nationwide, the added demand yesterday caused mortgage rates to fall.

For now, rates remain near the record levels set in early-January. As the Treasury clarifies its plan in the coming weeks. This could mean big changes for rates over the next couple of months.

Stay tuned. It will be interesting.

(Image Kudos: The Wall Street Journal)