The Big Day

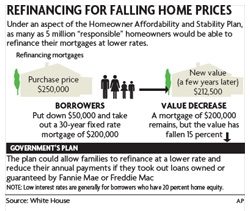

In Mesa, Arizona, Wednesday, the President presented the Homeowner Affordability and Stability plan, a multi-pronged effort to support the housing market.

In Mesa, Arizona, Wednesday, the President presented the Homeowner Affordability and Stability plan, a multi-pronged effort to support the housing market.

The story made the front page of nearly every newspaper in the country.

Objectives Were Clear

The president’s plan is trying to:

- Provide incentive for mortgage servicers to work with at-risk homeowners before delinquency starts

- Let homeowners with good credit but little equity refinance to today’s low rates

- Fund Fannie Mae and Freddie Mac to support mortgage markets

Take It For What It Is

Be honest. It’s a broad plan with many positive objectives. For now, we can’t forget that it’s just a plan. Although the White House shapes and influences our housing policy — Congress, HUGE Loan Servicers, and the Federal Agencies must still implement and execute it. Until that implementation occurs, these exciting reforms exist only on paper.

It’s a key aspect of the speech that’s not getting coverage. Go figure.

Learning From The Past

One thing we learned during the recent stimulus package debate was that just because the President wants something to happen doesn’t mean that it will. There are always details to be shaken out and that’s one reason why the Homeowner Affordability and Stability Plan couldn’t (and won’t) go into effect immediately. There are still loose ends to tie and details to define.

“Deadline”

According to its website, the White House lists March 4, 2009 as the plan’s effective date. Therefore, until March 4, nothing in Wednesday’s speech is guaranteed.

I also wouldn’t hold my breath on servicers participating in the capacity of this plan. It’s a big change in business for the (not that I think they shouldn’t, they’re just stubborn).

Stay tuned. This story will develop.

(Image Kudos: Birmingham News)